Apple - overvalued or an underpriced monopoly?

Apple is a company famous for its revolutionary products, which changed the perception of technology to many people. Once thought to be very hard to convince people to buy, technology is being used all around the world, and Apple is one of the biggest companies that is gaining from that. They are not only in the hardware business, but also software, operating system and their many services, which are subscription-based. So, is this company finally too big to expand mark Share? In this article, I will talk about my opinion on this company.

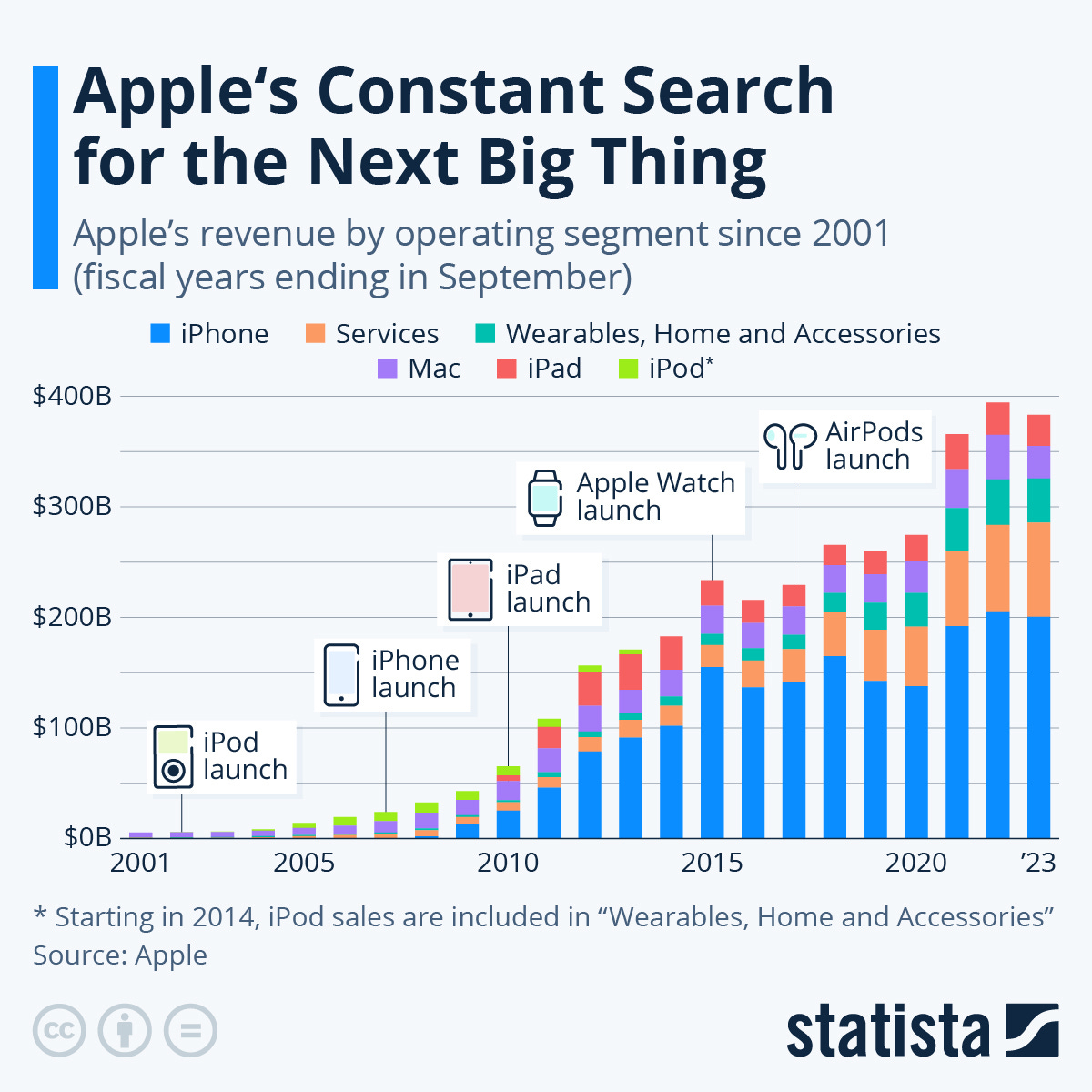

Apple’s market share of the devices market looks like this:

Take a look at their services revenue:

Basically, it’s unstoppable, as they can easily increase the prices, and people will still pay for their services. This is one of the elements of their wide moat. Another one is the closed ecosystem of products that they have. When you buy an iPhone, you’re basically unable to do anything that is connected with programming. I’m a developer, and I find it really frustrating, that I’m unable to download an older version of iOS on my iPhone 6s Plus. But that is one of the elements, that keeps you in their ecosystem. When you buy an apple tv, it works even better with an IPhone, as you can use screen sharing from your phone.

I conclude that their moat is very wide, and that is a positive aspect of this company.

Let’s move onto their financials:

Each time they showcase a new product, they have a high revenue increase shortly after that. They earn the highest net income per employee:

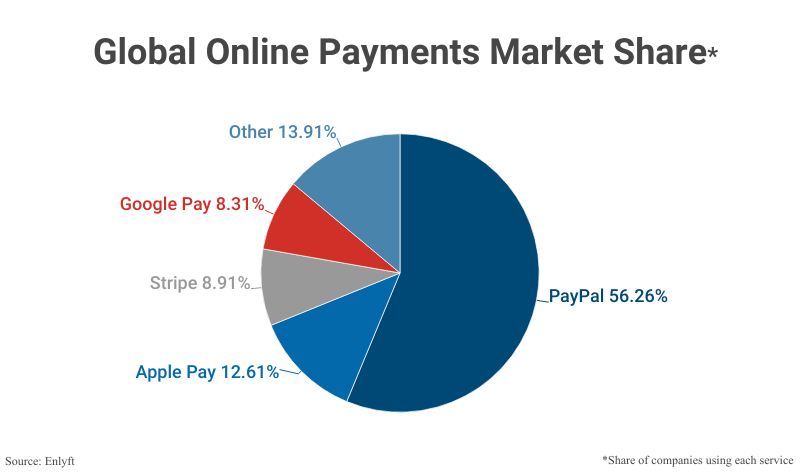

Their apple pay software isn’t beating PayPal, yet it’s still very popular.

They have been growing Earnings at an average growth rate of 13.9% annualy.

However now they are forecasted to grow their earnings at 5.9% annualy. They have many opportunites to grow: Ai, hardware and others.

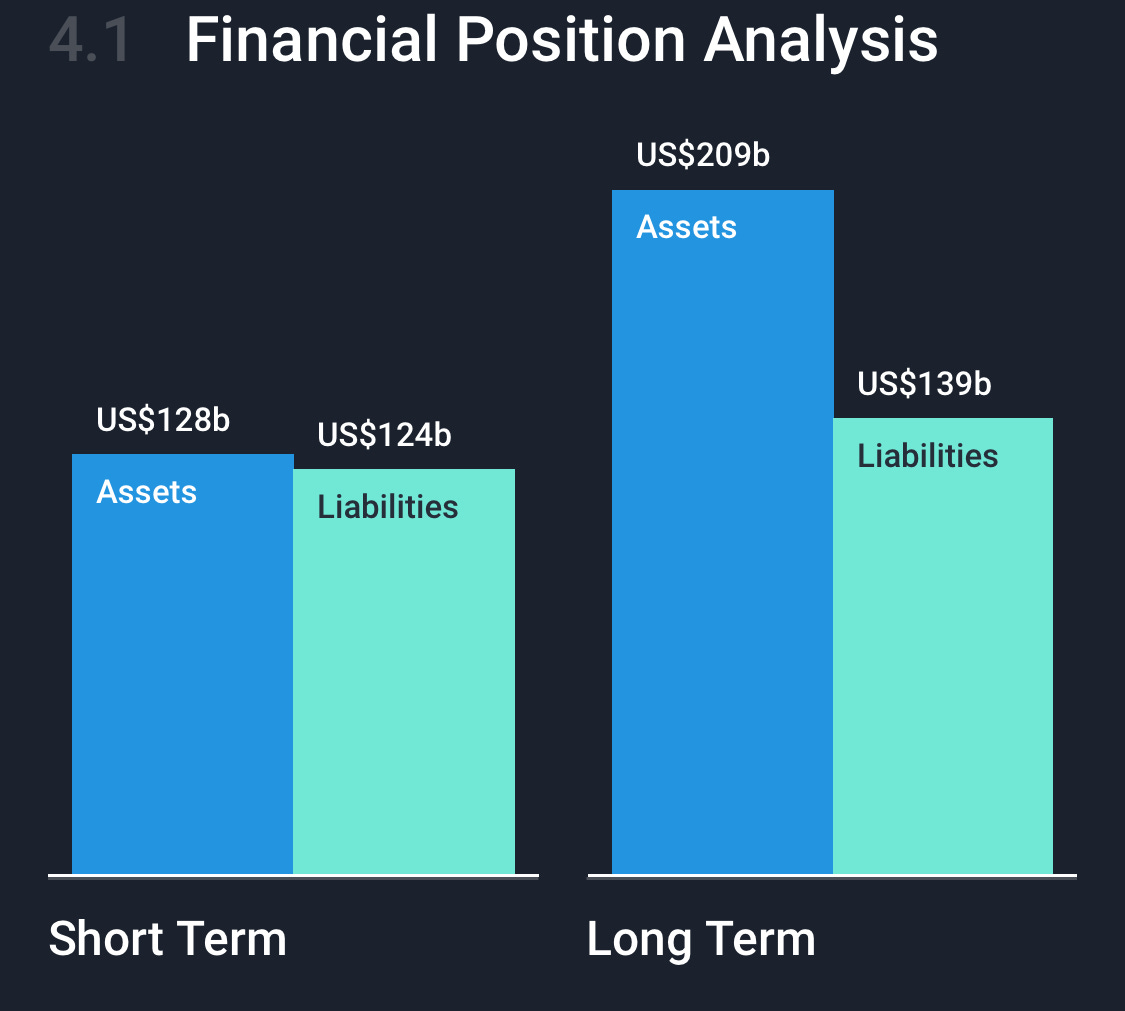

That’s how their balance sheet looks like:

Simplywall.st:

If you plan to buy a high quality company, that pays a dividend that is currently at 0.5% yield that is growing at around 4%, you can buy it, as it’s bound to exist in 50 years, just like Microsoft. I won’t be buying them any time soon, as I see better opportunities in companies like: Amazon, Google, Visa, Uber and Duolingo.

simplywall.st valuation:

This isn’t financial advice.