Barnes & Noble Education, Inc.

Swoosh! You enter your local school to quickly buy some art supplies for your school project, you race down alleys, and then you find some stationery goods. You pack a few paints and rush to the cash registers. You pay quickly, and a glance at the receipt shows the name of the store you just entered: Barnes and Noble. You, being a young investor, are interested in buying a company, but is Barnes a good one? Let’s find out! :)

For this analysis, we will use the help of Chapter Champ, the representative of this company.

Stock Information

Barnes & Noble Education is a company that is the provider of books and other things connected with education, like textbooks, courses, both in physical and digital versions.

But they don’t only do that. They are also involved in operating many digital and physical locations of bookstores for educational institutions and the so-called K-12 (from Kindergarten to the 12th grade). So they’re laser-focused on a very specific niche. They want to provide the best value for their customers. However, with the rise of AI and alternative learning sources, their business might be in some form of danger, and in this analysis, we’ll try to see whether that’s the case.

1. AI. Of course, AI is listed as one of the reasons for BNED’s destruction; however, let me come here quickly with an answer: no. The thing is that the education industry is regulated, and AI while posiing some danger to their busienss, as more people would use some sort of personalized learning like Duolingo instead of them, right now, it’s still mandatory to have a textbook at your shcool, and it’s unlikely to change for a very long time. Look how old the education system is around the world, yet we’re still using it. What a shame! But companies like Barnes and Noble are earning money from that process.

Amazon and other wholesalers

Amazon is the company that was listed as one of their competitors in their annual report, and they cited the fact that customers off their intermediary for the transaction, as they are performed without their help. Essentially, Amazon is taking market share away from the, by making those textbooks available online. The rise of AI replacing some dull jobs, such as truck drivers, will mean a rise in the possibility of cheaper books there, and BNED might have some problems around that, if they don’t switch to completely digital versions by then.

3rd party suppliers - They are dependent on other suppliers, such as publications, and once suppliers don’t have the books, neither do they, as they have 28% of their items sold bought from another supplier.

Strategic partnerships on marketing

BNED has access to a demographic known as college students, and so many brands want to advertise using their network of college bookstores, and these are their brands: DoorDash, Wall Street Journal, Dell and others.

School bookstores

Their school bookstores have the school’s custom-branded apparel or other items that could be used with the school’s logo.

Low switching costs for consumers

Students have a relatively easy way of going to Nanotherstore to get something cheaper. Remember, many people don’t have much of a choice in terms of picking a book, and so, when they see the price of their most needed textbook, and see it go up, they can go to a different store, and just buy it. Used books are also really popular, and fortunately, BNED is jumping into the cse, by building a platform for the students’ trades. So we can see that they have non-existent pricing power, which in simple words means: Their customers don’t care about who they are buying a textbook from, they just look at its price. They don’t want to overpay for a commodity like a textbook.

Another aspect we mustn’t forget about is the business that they are in is hhighly cyclical If for some reason your textbook is destroyed (My dog ate my homework, or gets tossed away in a maniac fight for survuival after a Minecraft battle, straight into a puddle of water), you won’t get it repaired. You’ll buy a new one. BNED is a genius at this, by making enough textbooks to suit the needs of their customers, by placing them in spots that they are likely to stroll by, and buy a textbook, or other useful items. Most of their revenue comes from the periods when students need to buy those books.

Cafes - they operate places where they make coffee and sell lunch, and they even own a Starbucks Coffee shop as well!

Those are all valid concerns as well as opportunities for this company, so let’s dive into how they make money, as that’s a lot of text! :)

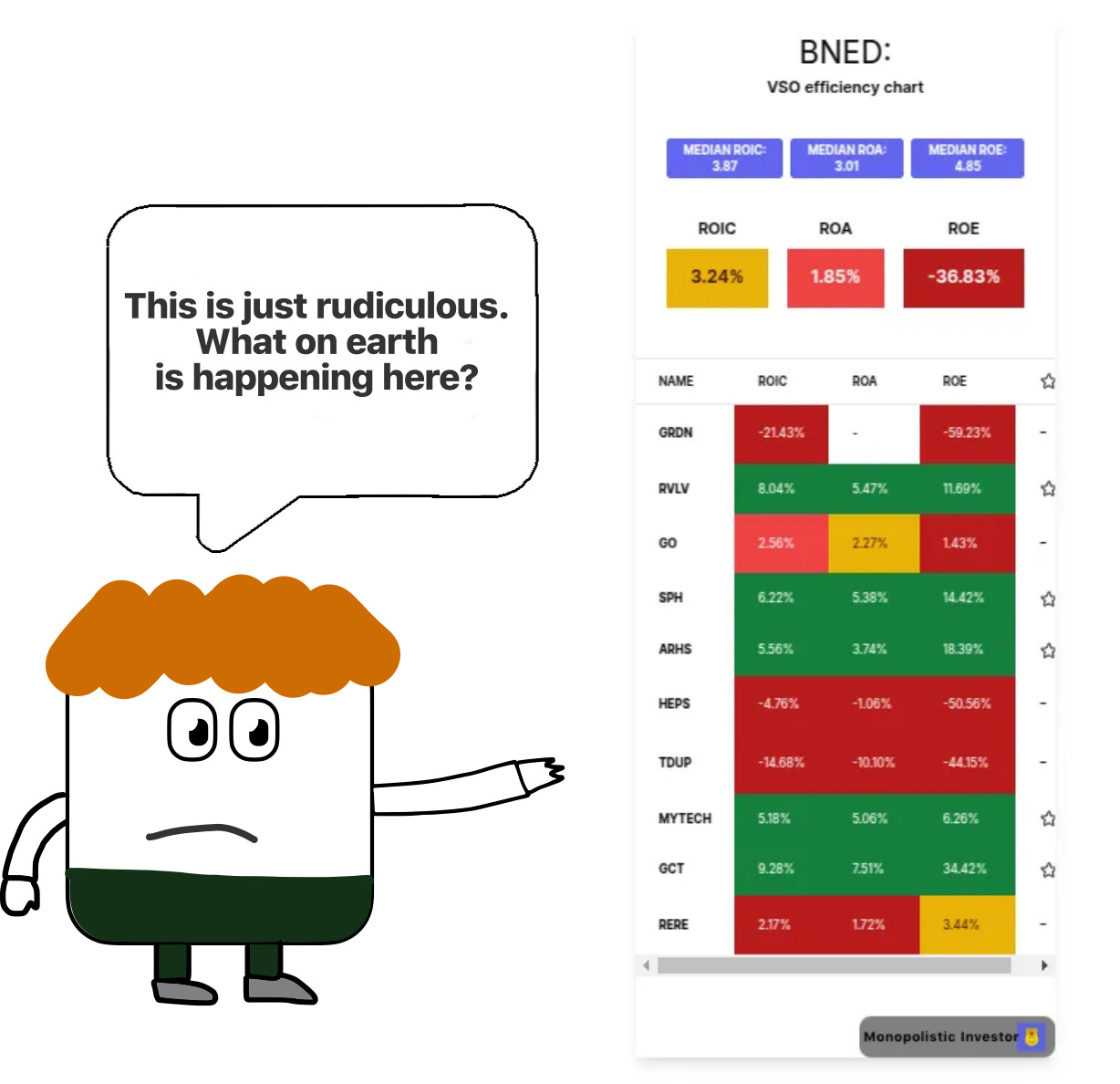

I think it all makes sense now, which is why we’ll be taking a look at their financial efficiency, as well as their profit margins, to estimate how they’re doing. This metric is on a TTM (twelve-month basis:

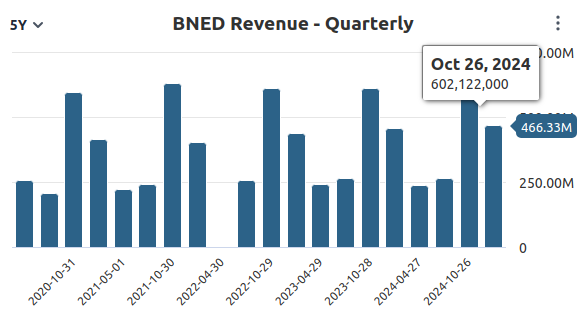

And we can see that they’re actively losing money. This isn’t anything new. Look at the revenue chart

It’s varied from quarter to quarter, due to students buying books near the beginning of the school year, but they aren’t growing

If we are to compare their financial efficiency to their peers, here’s how it looks:

We can see that they have really terrible metrics in comparison to their peers. Maybe those aren’t their exact competitors, s defined here:

So, please forgive me, but my tool, which I have created, isn’t perfect. It sometimes fetches only similar companies, not the exact competitors :(

What is the financial health of Barnes & Noble Education, Inc.? What is their debt level?

Moving on to the financial health aspect, which is overlooked by many investors, unfortunately, but is a fundamental way of looking at a company, and an easy filter to separate bad from good investments.

Here’s their situation visualised, using MarketVision:

We can see that they have more debt than cash, but a positive net equity position is a favourable outcome. What I need to mention here is that the equity to the cash isn’t proportional, and I will need to fix it at some point, but fear not, it will be fixed!

So positive here!

Let’s move on to the analysis of their market share, as we aren’t on a newsletter that is called the Monopolistic Investor for no reason, we want to invest in high-quality companies:

The market share is defined here, but note that it might not be accurate, as it sometimes includes companies which aren’t their direct competitors!

Valuation of BNED. Fair value of BNED

Thi sis the most interesting part, if we consider their growth, what our expected returns are likely to be? For that, let’s pull out a DCF calculator that is set for 10 years from now, and set a few scenarios:

Scenario 1 (No growth):

Scenario 2 (2% growth):

The projected revenue growth rate is 3% for this year (so few analysts covering this stock). The CAGR for the past 8 years has been -2%, so based on that, I’m going to apply that to the varied cash flow valuation, which is an intuitive tool, only available on my platform in this form:

Oh no! My app couldn’t fetch the FCF data! :( Sometimes it happens, but most of the time it works!

Memes on Barnes & Noble Education I made:

My Conclusion

Barnes & Noble Education shows no investment opportunity for me. It shows stagnating revenue, amid an industry which is slowly going to break apart under competition from the likes of Duolingo and others. Not a good buy for me.

It seems that we’ve come to the end of this article…