Click. You are a senior engineer, working at Intel, and you have a big job to do soon. It’s the new Intel Core i8 15th-gen chip. It’s going to be the most capable one, very made. You open up the software for designing the chip, a you haven't finished it yesterday. You get on the voice chat with your colleagues on Discord, and you start. Some time passes by, and then you take a look at the application tab. The name of the software you’re using is Cadence Innovus+ Synthesis and Implementation System, and you’re curious about the company behind it. You open up your email, and there’s an email waiting to be opened, directly from this company. Excitedly, you open it…

For this analysis, we’ll use the help of a Cadence company cartoon representative, Innovator Ian! Say hello!

Cadence is a software company that makes really complex software for anyone who wants to design their computer chips.

They make software which is called EDA - Electronic Design Automation tools, which help engineers to test and design chips, SoC (System on Chip) systems (Think: Apple M4 chip, with GPU, CPU all in one place) and PCBs (Printed circuit boards - think building blocks for any electronic devices, from servo motors to GPUs, PCBs are used everywhere.

They also provide IP (intellectual property) of ready-made chip components, making it easier and way cheaper to start developing your chips. It’s also less risky, as you are using tried-out elements! Examples are: memory controllers, interface blocks, and special processing units.

System Design and Analysis - They make software which is capable of testing the components against real-life physics, such as electromagnetic and thermal effects!

Services and Support - When you are a company that makes really complex software, naturally you are an expert i using it, and so they offer courses, training, consulting, and technical support for anyone who wants to use their software and get trained.

Hardware for Testing and Prototyping - even though they don’t produce the chips themselves, they do offer their clients an opportunity to use hardware systems that let them test and simulate their chip designs before they are manufactured.

But of course, that’s not all - they also make highly innovative technologies for the emerging technologies:

Artificial intelligence (AI) and machine learning

Cloud computing

5G communications

Automotive and aerospace electronics

Big data analytics

Some monopolistic traits I noticed:

Complex software, which is hard to replicate, and would be costly to replace.

Physics simulation, as well as pre-built parts, are all really useful components for a chip. That’s why it‘s so hard to replicate. They own a wide range of IP components, which help make chips faster, meaning more value for clients.

Let’s go over the positive side of their financial and business metrics, which are very well-positioned.

The wide industries their software can be applied to - I went over the presentation, and the car design was surprising to me:

As you can see from the graphics above, their software is universal, where electronics are used:

Automotive

Aerospace and Defence

Biotech/Medical Technology/Life Sciences

Data Centres and Cloud Computing

Telecommunications

Industrial Internet of Things (IIoT)

Consumer products (e.g., cell phones, automobiles, computers, home appliances, drones, home security, home entertainment systems)

Cadence’s customers are primarily concentrated within the semiconductor and electronics systems industries. As of March 31, 2025, no single customer accounted for 10% or more of Cadence’s total receivables. As of December 31, 2024, one customer accounted for approximately 11% of Cadence’s total receivables.

So, no single customer is more than 10% now, and that is positive - it shows that they have a diverse customer base, and that means that their revenue is less likely to be impacted by a single customer leaving.

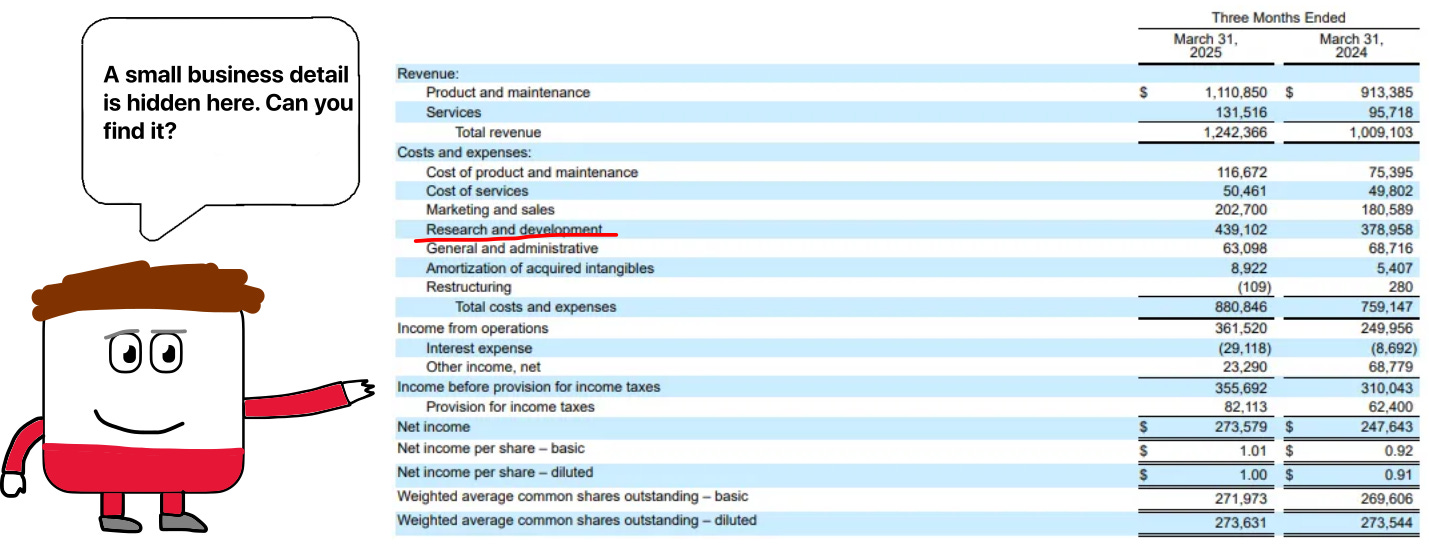

Revenue for them is growing at a really fast pace:

Here you can see their revenue growth on a Trailing twelve-month basis:

You can notice the fact that it’s double digits almost always.

The recurring nature of their business is something which can establish more stability in the investment:

As you can see form the image, even though we have the recurring revenue drop from 90 to 80%, it’s fine, as the up-front revenue going up, and that’s the result of them receiving more annual, or multi year plans, where the customer pays at once, instead of every month for example. This could signal some increased demand for their products, and could be a positive thing for investors, although it might sometimes make quarterly revenue a bit choppy, but still, at 20%, it doesn’t look like it’s going to disrupt the revenue to a wide extent.

Everything wrong with this company.

Their margins could be a bit better:

As they spend a lot of their revenue after costs to operating expenses, probably because they are investing almost a third of everything they earn into R&D (Research and Devlopemnet), which clearly shows their long-term view on the industry, and potentially to investors making more money, by having more resillient company, look at this chart, it shows you the exact amount of R&D:

Bear case:

FCF yields a bit lower than I like to buy at around 3-5% is great.

But their FCF yield has been on the low side for quite some time, maybe it’s nothing to be worried about - similar to Amazon? They invest for the future, and still they are profitable, so maybe it’s not that bad? We’ll look at their valuation later and see.

Actual data points that I can use to prove my point, but of course, it’s still just an opinion.

Financial health - the concrete example of a healthy company:

They have more cash than debt, and more assets than liabilities - the best combination of these two!

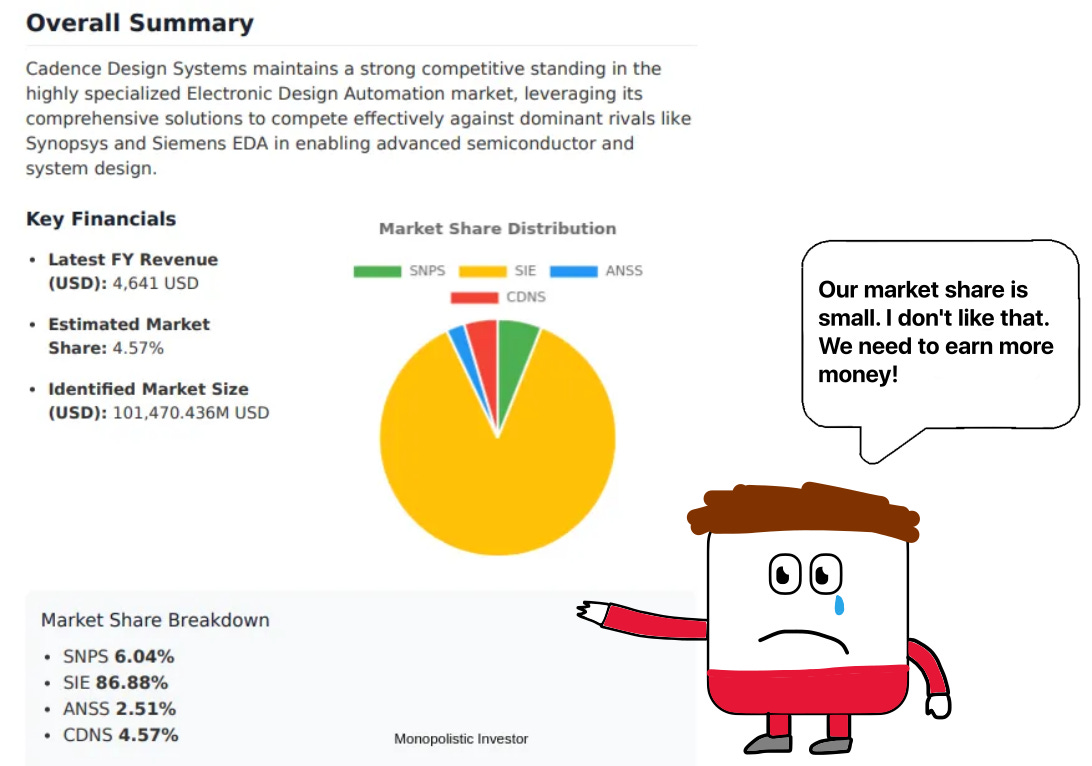

Market share - actual data, given their competitors:

Siemens is a much larger competitor - I guess we should look there at some point?

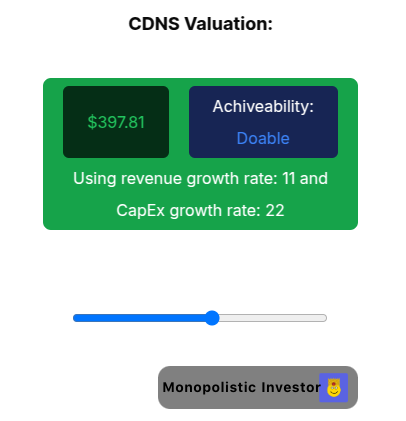

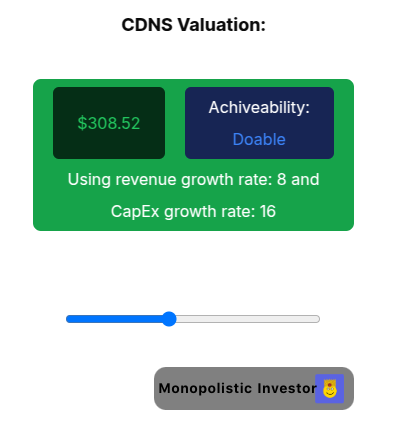

We don’t want to overpay for a company. Right now, I will use three valuation methods:

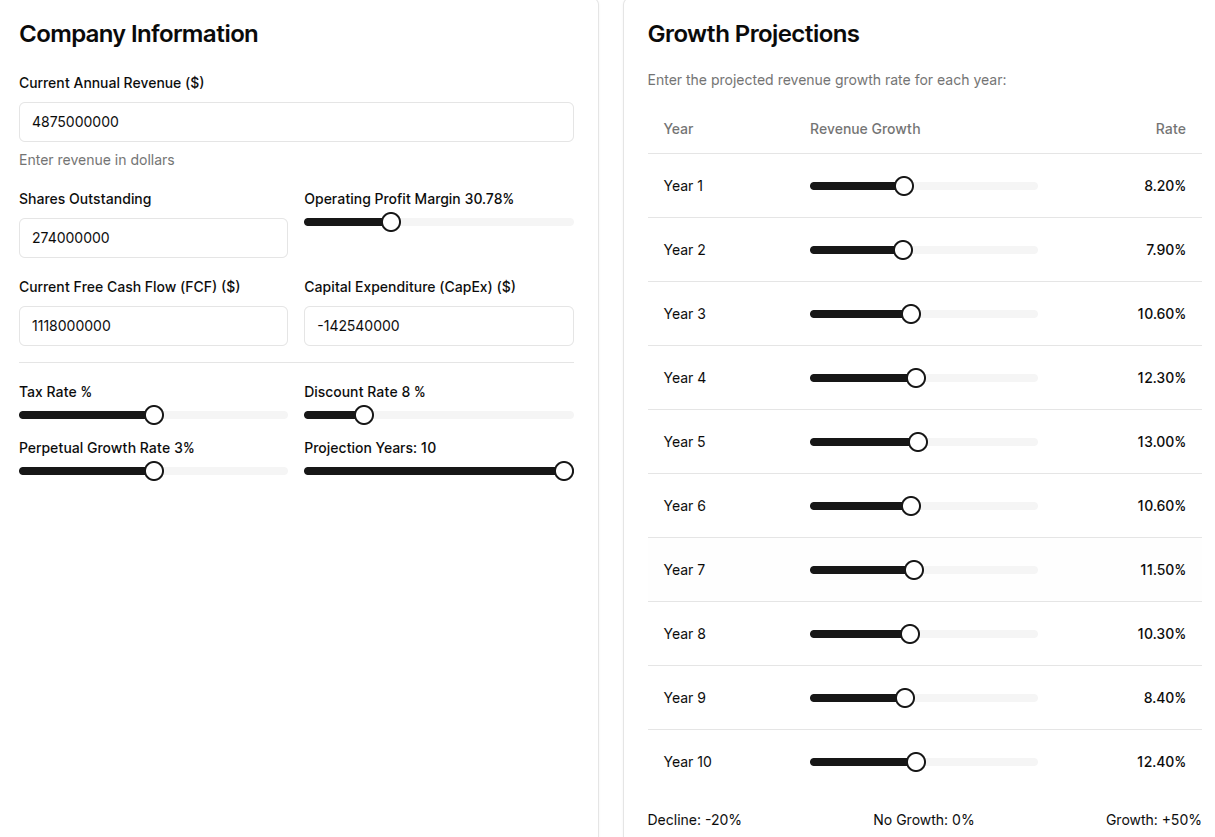

DCF analysis (10-year, 8% discount rate, revenue growth assumptions, based on their outlook for a CAGR of 8.2% up to 2026)

varied CF analysis - similar to DCF, but with a different revenue growth metric per year

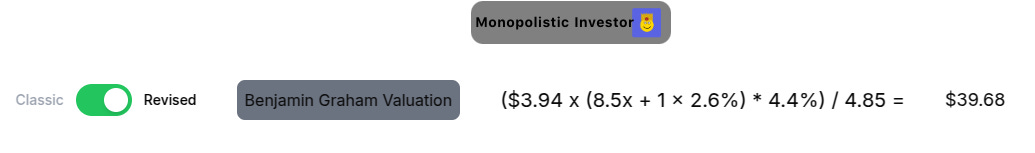

Benjamin Graham valuation - based on their last year's EPS growth (doesn’t work on unprofitable companies, obviously).

DCF analysis, 11% annual growth rate: $397.81

8% revenue growth: $308.52

Varied CF analysis:

We can see that even if we assume such rates, which aren’t that low, but also not too high (I would say they are reasonable, although maybe not realistic), we can see that it’s overvalued by 48% from current prices, its fair value at around $152.47.

This is based on lower earnings over the past few years.

If we assume more aggressive revenue growth, we still have them labelled as “overvalued”:

So, based on this analysis, the fair value of this company is $204.93, which is over 30% less than current prices.

Benjamin Graham valuation is still showing the company as overvalued:

$39.68 (Benjamin Graham Revised valuation)

$48.97 (Benjamin Graham Classic valuation)

A meme I made on Cadence Design Systems:

Even though I classify this company as high-quality, it is currently overvalued in my opinion, which isn’t what I accept. I want to buy a company on a dip, but this one doesn’t seem to be there yet. I will watch this company, and maybe I’ll add to it at some point.

Stay Monopolistic.

This isn’t financial advice.

What’s your view on the competition with Synopsys?