Copart.

Vroom! You drive out of a car yard in your very first car! It’s used, cheap, and to tell you the truth, the buying process was easy. Get an alert on your phone about a deal you are looking for, go to the car yard, inspect the car, and then sit in the comfort of your home to bid against some other bidders. You got there faster. And you got it. Yes, you would have to pay $99 this year to access this platform, but it’s great. You look at the giant sign near the car yard. It says Copart. But is this company investable or it’s just car junk? Let’s find out! :)

Copart company Information /What does Copart do?

Copart is the leader in a network connecting car buyers and sellers. What usually happens is that when you have a car accident, the insurance company might mark your car as a ‘total loss’, meaning it just doesn’t make any sense to repair, as the cost of the repair is more than a certain percentage of the vehicle’s value. Hearing this, insurance companies want to get the most out of your junk, so their primary marketplace to sell is Copart, which provides a fast way to salvage some money back from the cars. (around 86%)

Other than that, Copart also makes a smaller yet still significant part of their revenue from the ‘Vehicle sales’ segment. This is when they purchase a vehicle on their own and resell it, thus acting as a principal. (14% of whole revenue)

Above all of that, they do compare themselves to more of a ‘wholesaler’ rather than an actual car dealer, and that’s one of the reasons why they are succeeding. They are a subscription-based business. If you want to participate in their online auctions, you must pay at least $99 a year. Can you see this trend? Many great companies like Netflix, Costco and Google have adopted the same principle. Subscriptions are the Holy Grail of investments due to their predictable nature, and remember: what do investors like? Predictability. What we see here is their big bet on the services revenue, which is fantastic. I believe that companies with Subscription products will win in the long term.

Here are the prices of their memberships:

As you can see, it allows them to have great pricing power; they literally can raise prices by 20%, and people will still pay. Great!

Is Copart’s business resilient to economic downturns or not? Is it recession-proof?

Short answer: Not really. Longer answer: I read their shareholder letter, Based on what it says, (and they talk a bit on cars - who would have expected THAT?), they talk about how the implementation of autonomous brakes as well as anti-lock brakes, impacted them, and it impacted them positively, which might seem counterintuitive. Isn’t a safer car less likely to break?

The answer is no, and the reason for that is the amount of semiconductors in cars today vs practically zero 50 years ago. Around 1,000 – 3,000+ semiconductors are in the car you’re driving right now. What happens to semiconductors? They like to break when you smash into another car, implying more cost and labour that is involved in repairing a car. For that reason, we can say that this company is resilient, as broken cars happen all the time, people pay insurance companies all the time, and Copart will be here the whole time to help both of these groups.

Check out the 30-day free trial period of my paid subscription.

A negative impact can be attributed to the slightly cyclical nature of the whole business. Economic recessions might cause a lower amount for cash to spend by consumers, who might prefer more repairs than just scrap metal. Buyer Financing and Demand also has a root problem here. During an economic downturn, buyers of cars don’t buy too much, and so that can drive their revenue down.

Economic downturns can also make the prices of the used vehicles go up sharply, reducing the economic viability for insurance companies to put an offer on Copart, thus reducing their overall revenue. In comparison to Auto Zone, this business can be more challenging to maintain during such times.

Who are Copart’s competitors / Do they have a monopoly in the industry?

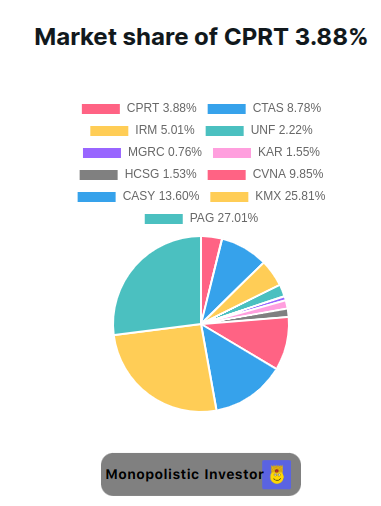

Copart operates in a very niche business, which means lower competition and potentially higher profits. Let’s see their total market share, with very similar companies, or their competitors: (I made a tool for that, which I available to all my paid subscribers):

As you can see from the image above, they hold a small market share, but let me say, that it’s not ALWAYS accurate, and it might source some additional companies, which aren’t their direct competitors.

Companies that are direct or indirect competitors:

KAR (OPENLANE): Direct competitor in vehicle auctions.

CVNA (Carvana): Indirect competitor in the used car market.

KMX (CarMax): Indirect competitor in the used car market.

PAG (Penske Automotive Group): Broader competitor in automotive retail.

Insurance Auto Auctions (IAA) - direct competitor

Manheim (Cox Automotive) - indirect competitors

So a chart would look similar to this, but with RBA (bought and Manheim added [not public):

My tool isn’t perfect, but you know what I mean.

Moving on to their financial efficiency:

What is Copart’s financial efficiency? Is their business capital-light or is it really expensive to maintain?

For that, I made it so that it would be easy to compare all of these metrics and meet my VSO chart (versus others):

They are positioned pretty well against their competitors, with their financial efficiency ratios (roic, roe and roa) being above the median values by a wide margin (the two first), but nevertheless, a great business here!

What is Copart’s financial health? Are they in debt trouble?

Many investors these days jump into stocks because of emotions, and not calculations; however, not like them. We take a quick look at a company’s financials and just check what is going on here (generated by my app, which will be available soon to paid subscribers [around 1 week):

As we can see from the image, Copart has way more cash than debt, and the equity available to shareholders is also positive. That’s what I like when researching companies. They don’t have trouble paying off third ebt, with their debt sitting at just around 0.01, meaning it won’t even take them one month to pay it off (0.01 years).

Great value here? Let’s see with my DCF calculations here:

What is Copart’s valuation / what is Copart’s fair value?

Copart is a business just like any other, so we don’t want to overpay for it. Using a DCF calculation, with a discount rate of 8% and, revenue growth rate of 9%:

We can see it’s undervalued, the current price is at $57.95.

This is a realistic scenario

as I checked their past growth rates:

If we take a more conservative approach (5%):

And we can see it is overvalued now, at $51.37 fair value.

Now, let’s get to the conclusion.

Conclusion on Copart - is it a buy?

Copart is a very high-quality business, but any expansion they want to make comes with very high costs, however, they have shown that every facility they own turned out to be very successful. Every person willing to bid on their platform for cars MUST pay $99 or use the 7-day free trial. Great! I do think that the overall trend of our economy is showing a healthy indicator for Copart, but they do face some issues with competitors, so I’ll rate this a hold. What do you think?

Check out the 30-day free trial period of my paid subscription.

This isn’t financial advice.