Thud. Thud Thud. You hear loud footsteps in the school corridor. It’s your friend. You look at his huge shoes. They are different. They are made of plastic. You look at the logo. It’s Crocs. A company who turned the world of shoes upside down, and made people buy their shoes in a fever! But is it a company that is worth considering buying? Let’s find out!

Stock Information

But what do they even do? Crocs makes shoes and accessories. Comfy clogs, but they also make sandals, boots, and other footwear. They also own a brand called Jibbitz. It makes unique, colorful products for kids to personalize their Crocs shoes and accessory items.

A really great form of recurring revenue - as well all know, children get bored easily, and will point to these items, and will make their parents buy them!

In terms of their ROIC - 19.06%, which is a good value, for a company in the apparel business.

Gross margin is 58.15%. ← Literally they’re shoes made from two pieces of plastic.

Operating margin: 26.16% ←some costs

Net profit margin:20.50%. ← Yeah, the government just takes the money

Good work, Crocs management!

Oh no! Their market share is very small, what now?

Financial Health

"To know that we know what we know, and to know that we do not know what we do not know, that is true knowledge."

Nicolaus Copernicus

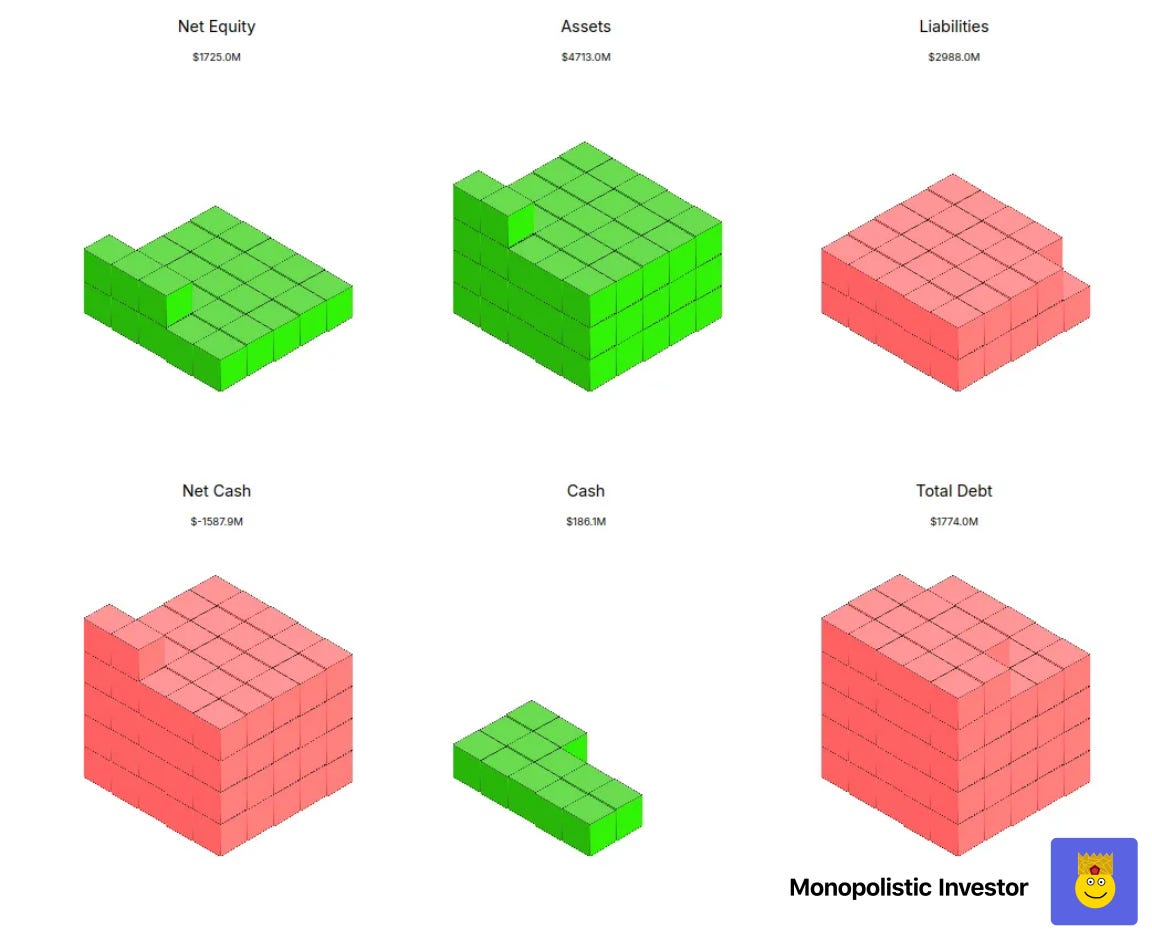

This quote by the Polish Astronomer, Nicolaus Copernicus, perfectly expresses our situation: we need to know our investments very clearly. No better way than through visual analysis. (For the eagle-eyed readers out there, you may have noticed that I moved completely out of interactive elements by now, the reason is that I’m making an app for investors, which will have those features, and for now, I’m just attaching screenshots of the app, here’s what I recently made - it’s a clearer view of the financial situation of Crocs) - Hope you enjoy :) (Green cubes mean positive, red ones negative values).

We can see that they have a net equity on the positive as well as a net cash position on the minus side. I’m really unhappy about it! Debt is at gigantic levels ($1.74B)! 😔 But at least their net equity is on the positive side, it would be a tragedy if it weren’t!

Their debt to EBITDA ratio is sitting at 1.38, meaning they could pay off all their debt from their earnings in 1.38 years, but that’s earnings, and not net income, let’s keep looking!

We can say that their financial health isn’t in the best shape. I would say it’s the sight that will make every investor run for the hills!

If you have any ideas on how to show complicated stock metrics easily, let me know, and I’ll try to create it! :]

Revenue growth

We want stable cash flows, and high pricing power, not a “me-too” approach from a company. We want a company almost synonymous with the industry, and guess what? Everyone basically calls ANY sghoes that look similar to their company shoes, calls them CROCS. Not plastic shoes, but Crocs. Just like Hoover is the a name that comes from the company who invented it! 😊 Let’s see how they are doing!

We can see that they do have pricing power of some sort, but it’s not enough. Look at their net income (it’s too unpredictable)

Revenue growth: OK 😐 (High gross margin makes me stop here for a moment)…

Dividends and buybacks

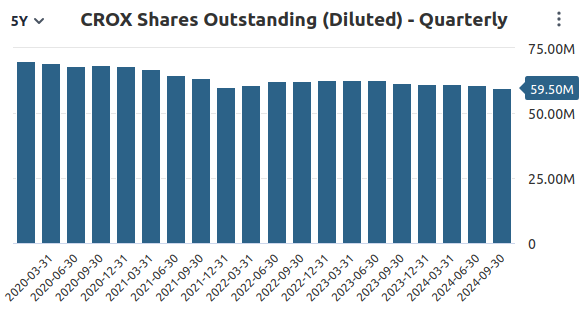

Who doesn’t like additional money in their brokerage account. I don’t know a single person who says that. And rightfully so. While Crocs doesn’t offer dividends, they do share buybacks. Look at their shares outstanding chart:

A buyback yield of 2.83%, with a FCF yield of 14.53% sound interesting. We must remember, that after buybacks, dividends eventually come, so keep that in mind.

Dividends & Buybacks ✅

Valuation

We want to get the best bargain right now, for a high quality company. But are they undervalued? Let’s see!

Forward PE: 8.73

Don’t turn into a “value investor” looking for companies with below 10 PE, look for high quality monopolistic companies. :)

Here’s the valuation:

Conclusion

While Crocs certainly has a great product, that is unique, with a high gross margin, and buybacks, I don’t see the much-needed stability in their business - I run a tshirt business, so I know how it works :). Apart from that, their small market position makes me uncertain about whether or not to invest in them. Of course, companies can always grow, but the thing is, can they raise prices, and still have people willing to buy? Apparel is tricky, so I won’t invest just yet.

Thanks for reading this, if you didn’t enjoy this, let me know, if you did, tell me what to improve! :)