Whirr. Beep beep beep! You are taking your money out of your local ATM. You put it in your wallet and go to Walmart, and buy a gift card for Amazon. Then you think “Which company is behind all of this?”. The answer is Euronet Worldwide, a company you might only know from their ATMs, but they are much more than that. Are you ready to check if they are a good company? Let’s find out! :)

For this analysis, we will use the help of Euronet’s cartoon representative,

Greg the Cash king.

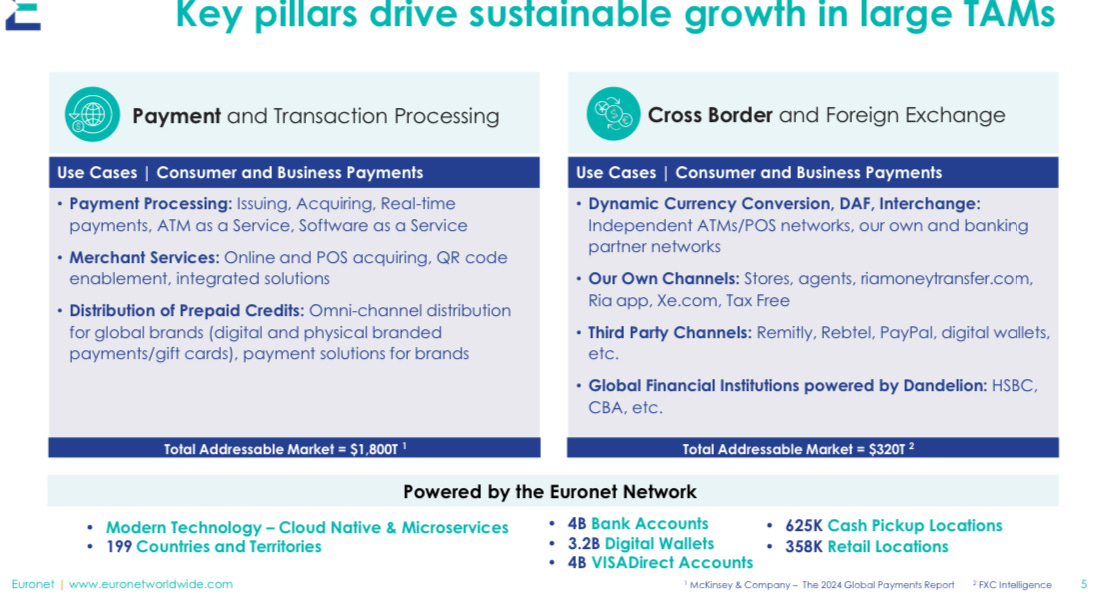

This company operates ATMs, through their EFT segment, which also supports POSes, or point-of-sale systems. They support the withdrawals, currency exchange, cash upload and other value added services.

Their „ePay” segment is used for their gift card offerings - they also make the buying of airtime possible in 700k locations, but not only as they also give the opportunity to pay via electronic mobile services.

Of course, money transfer services are also present:

They offer cross-border money transfer services, which are supported in 199 countries and territories.

Ria Money Transfers offers international transfers with a special focus on emerging markets. 20 million customers use it regularly. Their Xe app offers customers an opportunity to buy properties overseas, Dandelion is a product that also allows for cash transfers but with more flexibility in payout options: bank accounts, cash pick up, and mobile wallets.

Their revenue mix for their FY 2024 looks like this:

Some monopolistic traits I noticed:

Complex, regulated business - their products are really connected in our cities (ATMs), and they have to be regulated by official government institutions - this is a big barrier to entry for new entrants, making it an essential part of their moat.

Let’s go over the positive business metrics that they have:

199 countries and territories- a geographical element of their moat - physical locations are hard to copy only with money, as it’s also a matter of regulations and time, so their competitors would be slowed down.

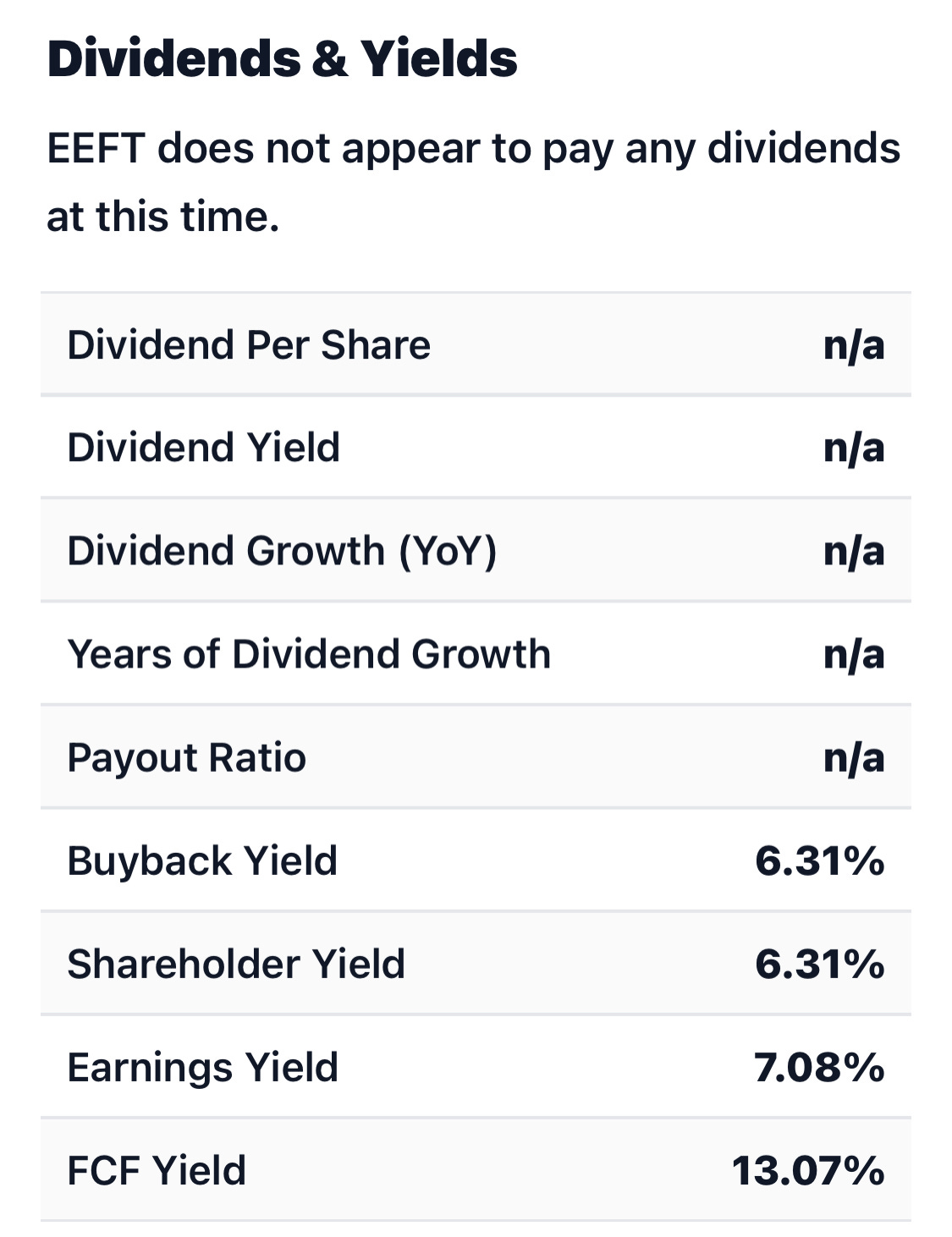

Their FCF yield is rather high, which could signal a possible undervaluation signal, because at 13% it’s unusual for such a company, in my opinion:

30 years of experience: high-value knowledge which was gathered over the years - hard to copy for a startup.

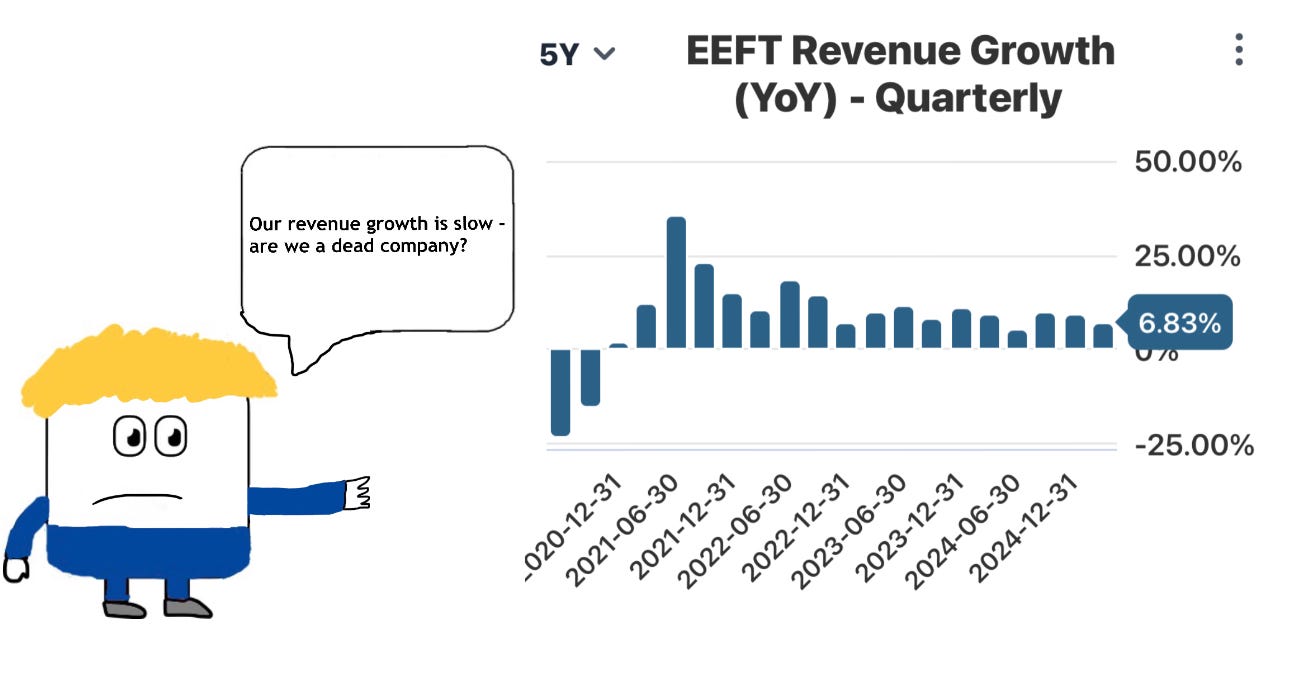

Revenue growth is really slow, barely above the levels of inflation (around 3%), so this company is basically growing at 3-5%:

The majority of their revenue (74%) is denominated in currencies other than the US dollar, which can be a significant risk in terms of their operating income being unstable.

My home country’s currency is the last one mentioned - can you spot it?

Seasonality: because of people travelling around the world during holidays, that directly impacts their dynamic currency exchange revenue in Q3 of their fiscal year, and also because of migrant workers working patterns, their money transfer services also experience a hike:

You can also see their profit margins aren’t the absolute best:

This analysis can’t be complete without ne mentioning objective business metrics, so here they are:

They have a good market share percentage, sitting at 14.26%:

Their financial health is showing signs of a healthy company, with a net equity position, but with their negative cash balance it can impact their short term liquidity:

We can see that the net equity (shareholders equity) figure is large, but their short term liquidity ratios: current and quick are low, and if they are too low, it could signal trouble and they might not be able to meet tgeir short term obligations:

Here we can see that based on three valuation methods, their fair value per share is as follows:

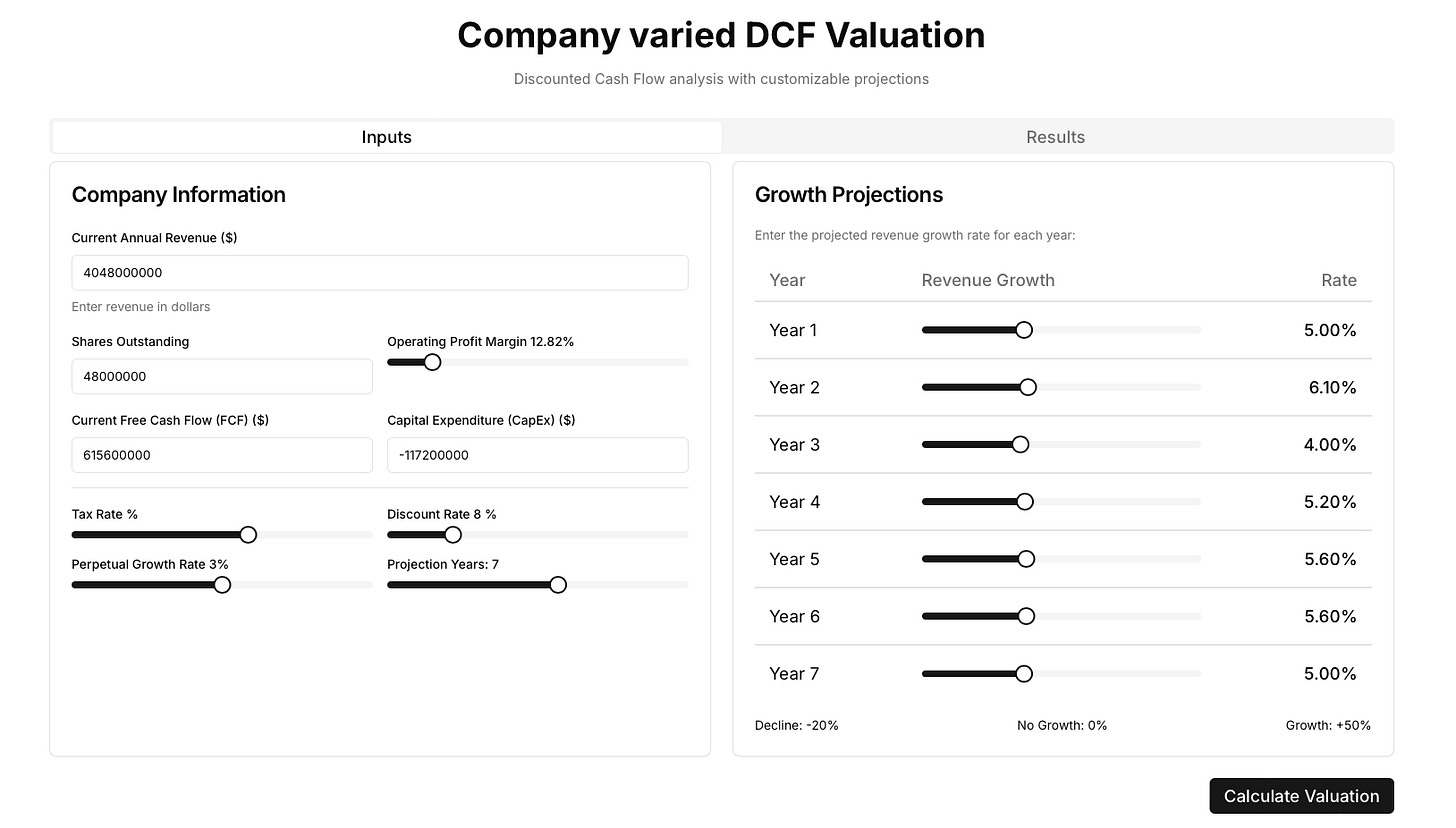

DCF analysis (10-year, 8% discount rate, revenue growth assumptions 0 and 4%):

DCF valuation scenario 1: $694

DCF valuation scenario 2: $1015

Benjamin Graham valuation classic: $288.62

Benjamin Graham valuation revised: $171.08

Varied cash flow valuation: $178.66

My meme on the company:

I see this company as the one which has many different ways to get revenues, contracts with other people, overall many opportunities to grow as they have those physical location of ATMs. I think that because they own the finance apps, Ria and Xe, as well as Dandelion, it means they can try to monetise those users somehow who are used to the app. For me, this company isn’t a buy as they have a bit slow revenue growth, and a bit slow profit margin expansion.

This isn’t financial advice.

Stay monopolistic.