Intel is reporting earnings this week - why I believe this stock is doomed.

Hello guys, this week a few tech companies are reporting their earnings, including Intel - a company which many people have heard of, but I don’t like it. If you haven’t been living under a rock, you know that they make the processors used in many computers that you own, but they aren’t limited to ONLY processors. Here’s a diagram showing their products:

They are also involved in driver assistance products as well as various software products.

Their revenue has been on a decline, and they also cut their dividend by about 50%, which shows you that they can’t sustain it for now. Why do they have this problem? They are essentially competing with the likes of Nvidia, Tsmc and others, and with their current cash allocation strategy, it’s just not working.

As you can see below:

An ROIC of 1% is just terrible, you would have a better ROIC buying Mdlz, which has an ROIC of 10.35%.

Analysts are expecting Intel to report revenue of $12.9 billion, and EPS of $0.10.

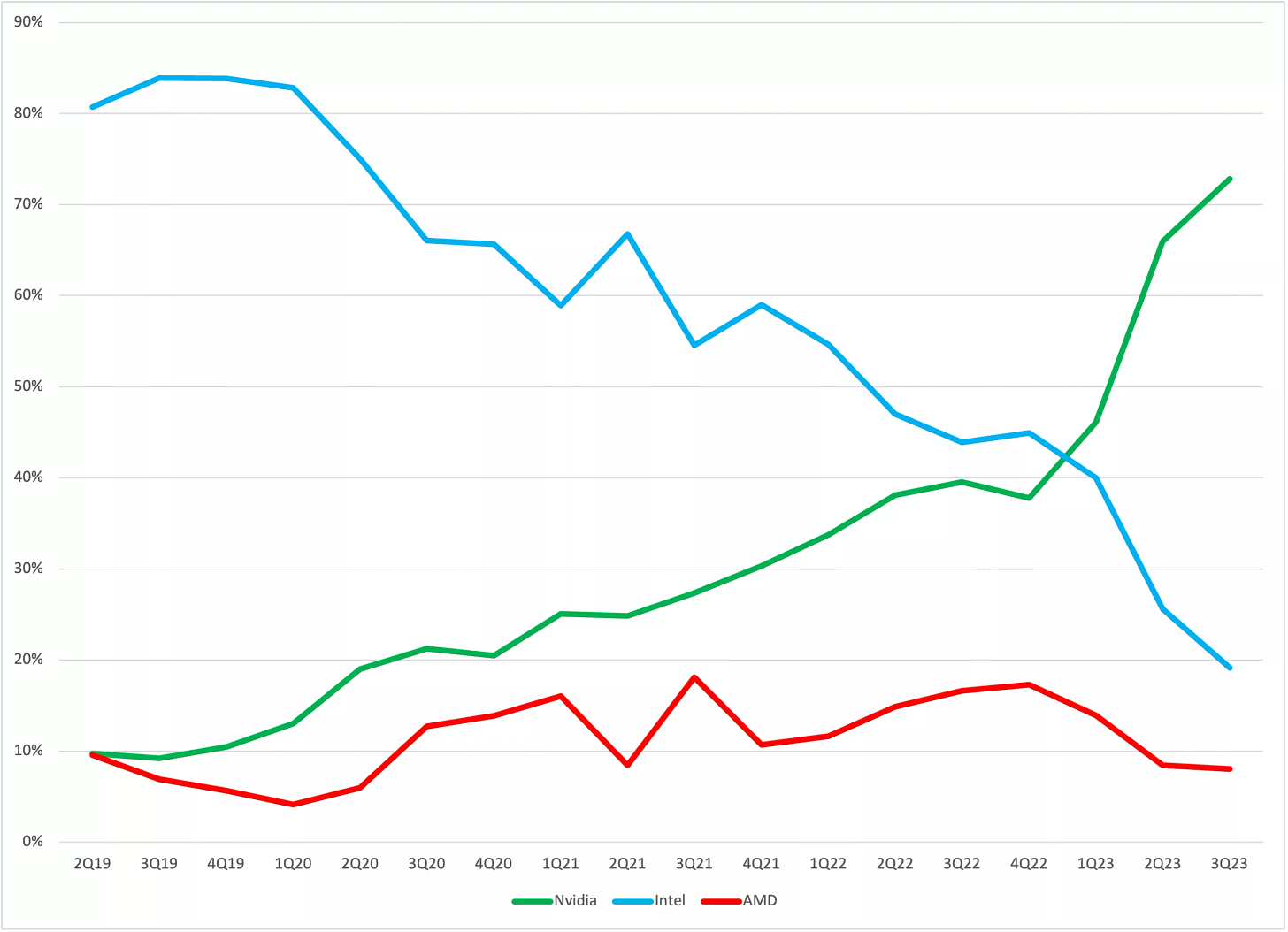

Their market share position is as follows:

Overall, I think that Intel will miss or keep earnings in line with the analysts expectations, as they have slowing if at all growth.

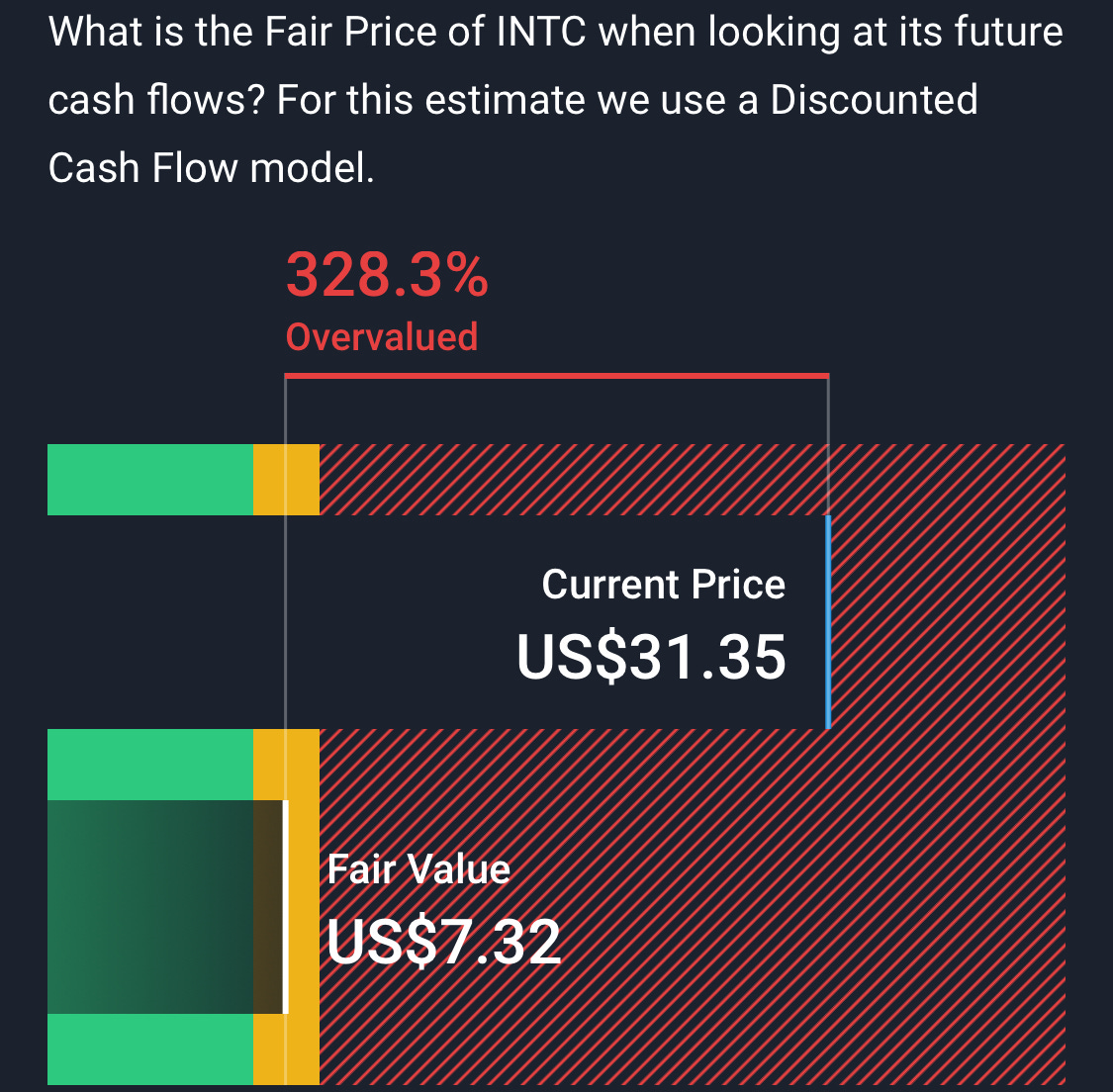

SimplyWall.st valuation: