Is Domino’s Pizza a great stock or an old pizza?

Hello guys, today we’re going to talk about Domino’s Pizza, a company which many of you must have been to, and as you know, they make pizza!! Who doesn’t like a pizza? I guess you like! Let’s look at whether this company is currently a buy right now.

Do they have a Monopolistic position? Let me check, as I’m the Monopolistic Investor, obviously (pun intended 😂):

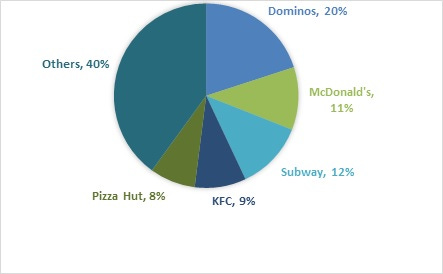

From this chart we can see the total market share they own:

But do they have pricing power? In my view, yes, as they have:

Strong Brand Recognition, I mean who doesn’t know them? :)

Focus on delivery. You can see that they put a strong mark on the delivery and online side of their business.

They show a better value proposition. You can see their and competitors deals everywhere, but that doesn’t stop Dpz from having the most loyal customers! Check out this article: https://www.allrecipes.com/the-best-pizza-chains-7852858

Monopolistic Position checked! :)

Revenue

Do they show strong revenue growth all the time? Analyzing those few charts, I don’t see a very good thing. Too much irregular growth.

compare it to a company like Chipotle:

Compared to MCD:

Sorry Mr Krabs, CMG beat you. Mr Krabs:

PS> SPongebob is CMG.

Loo at the queue in the background!1

Much more consistent revenue growth, but it’s in a diffrent niche of the QSR business. I own SBUX, which is fortunate, as I bought 1 share when it dipped, and another one before the dip, I think at $88, so I’m not buying Starbucks, but DPZ is an interesting company, so let’s look at their health. I’ll give them a tick here.

Revenue ✅

Their financial health looks like this:

No comment. Like Plankton’s restaurant.

Financial health ❌

Let’s look at their profit margins, are they going up or down?

Definetely staying around the same place, which means, when connected with their revenue growth, which this quarter is 7% YOY, we can conclude that they are earning more money than last year, by at least 4%.

Profit margins stable = ✅

Future growth:

Will people stop eating pizza? No.

Forecast:

Revenue next quarter: 1.54B +9.62%

EPS: 5.12B 14.60%

next year:

Revenue: 5.17B +6.70%

EPS: 17.96 +10.09%

Not bad, but could be better.

Future growth: ➖

Valuation: ❌

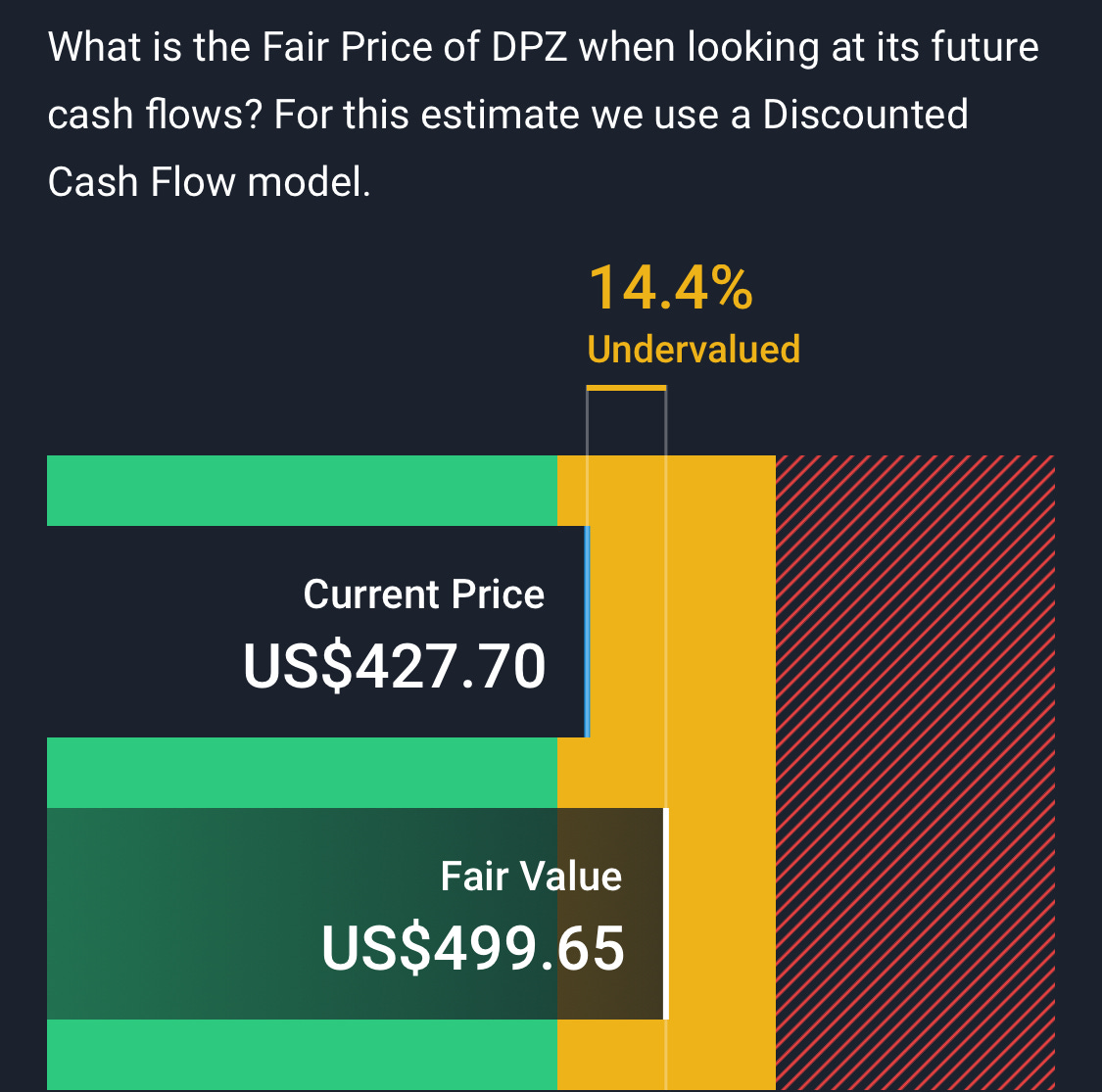

Simplywall.st’s valuation:

Conclusion:

Google trades at around 40% upside right now, so I would buy them instead, but currently, I’m sitting on cash and waiting to puonce on a drop. Just wait until September 18th. And remember, I said it :).