Johnson & Johnson vs Pfizer.

Beep! Beep! Beep! You open your eyes, and find yourself on a hospital bed. You’re shocked. What happened? Thinking about that, your gaze comes upon a table, sitting on it is a single box of Tylenol, made by JNJ. Turning around, you see some poster on a wall advertsing the power of vacinattion. At the bottom, you see a small logo of Pfizer. Today we’re going to discuss two pharmaceutical companies, namely - Johnson and Johnson (JNJ) and Pfizer (PFE), whether I will buy anytime soon, are they even worth it, and their breakdowns all right here. Let’s get into it! 🏥

JNJ vs PFE - stock information

Both of these companies operate in the medicine industry. Both of these make drugs for diseases, but here’s where they diverge:

JNJ makes medicines for very common diseases - cold, sore throat, that sort of thing. They make surgical tools and contact lenses, but overall, they have a more diversified business model.

PFE on the other hand, is primarily concentrated on making medicines for life-threatening illnesses, like cancer, heart disease, and rare genetic disorders.They invest heavily in research and development to bring new treatments to the market.

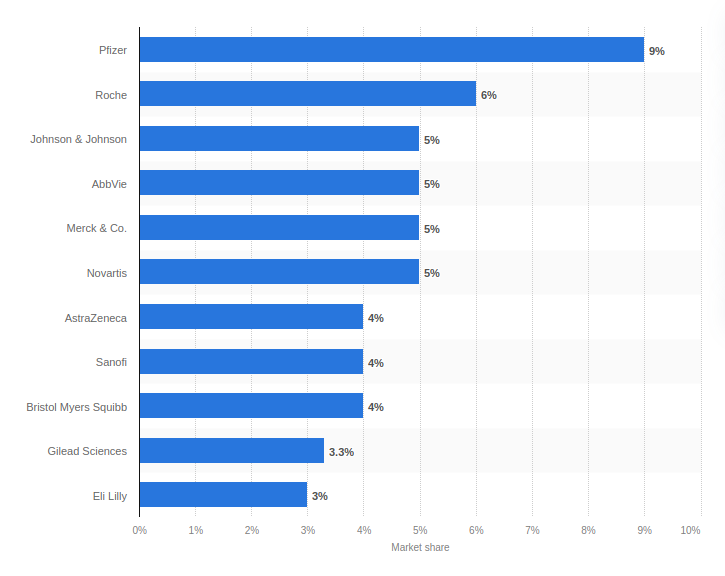

Here’s the market share:

We can see that PFE has the biggest market share, although in the charts, we can clearly see JNJ is not in the worst position, chasing PFE by a few percentages.

We can compare their EV (Enterprise Value) and Market cap:

JNJ: Market Cap: 354.07B Enterprise Value: 369.52B

PFE: Market Cap: 143.18B Enterprise Value: 202.90B

We can clearly see that JNJ has the bigger company, so that’s a point for JNJ, as I want a monopolistic company.

Operating, Net and Gross margins:

JNJ:

Gross Margin: 69.39% Operating Margin: 26.40% Profit Margin: 16.74%

PFE:

Gross Margin: 69.78%Operating Margin: 19.36% Profit Margin: 7.16%

While both of these stocks have high gross margins, their profit margins differ a lot, with JNJ’s being twice of PFE’s! Now that’s great! :)

Financial health

The most important aspect in every investment, after all, you want to be absolutely sure about the state of the company, right?

Yes, exactly! :)

That’s why you can look at my financial health analysis, which I programmed myself, by clicking on the images below! (Sadly no interactive elemnts yet on subtack):

Looking at both of these assets to liabailities ratios, we can see JNJ’s slightly better financial position, but let’s not forget about our small friends: Debt / Equity ratio, as well as the net cash! 👻

JNJ:

Debt / Equity: 0.51 Debt / EBITDA: 1.18

Cash & Cash Equivalents: 20.30B Total Debt: 35.75B Net Cash: -15.45B

PFE:

Debt / Equity: 0.73 Debt / EBITDA: 3.46

Cash & Cash Equivalents: 9.95BTotal Debt: 67.95B Net Cash: -57.99B

Phew! That’s a lot of data! However, we aren’t scared, and we can come to the conclusion, that JNJ’s debt / EBITDA is much smaller than PFE’s, so that means that JNJ would pay off their debt in 1.18 years off their earnings, compared to PFE’s 3.46 years. Debt to equity is also smaller in JNJ’s case.

I don’t know what you think, but JNJ is a pick for me! Cheers!

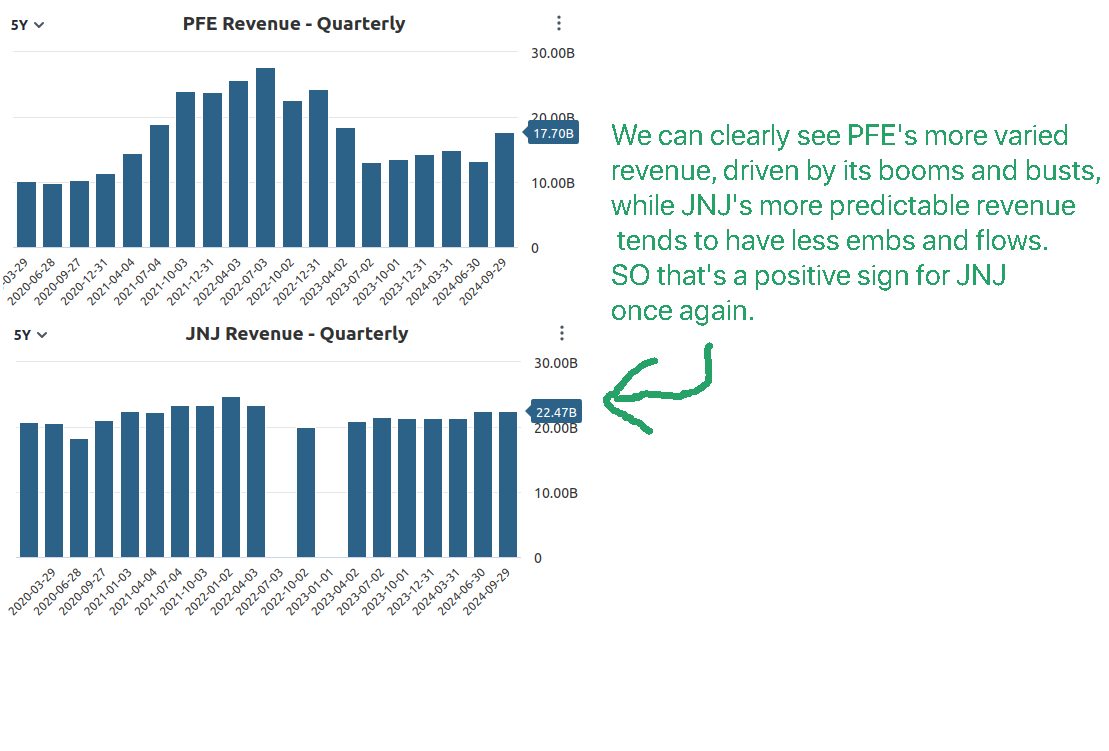

Revenue growth

We want a company, whose past and forecasted future revenue growth looks really well. Are any of these a good option?

A short analysis on each of these companies’ revenue tends to make JNJ a better pick, as their revenue is far more stable and dependable, which makes it the better pick over PFE.

PFE shareholders (being scared every time PFE’s revenue goes down):

JNJ (calm as ever), small dip

(Patient investors, not short sellers) Ha ha!😊

Dividends & Buybacks

That could be the name of a chocolate! 🍫

Anyway, here are their metrics:

Pfizer’s payout ratio is at a staggering 225%, while JNJ’s at 85%.

JNJ’s dividend growth rate is at 4%.

PFE has an even slower dividend growth rate than JNJ’s - 2.44%

So considering this, JNJ wins in this category.

Fun fact: Did you know JNJ has a better credit rating than the US government (AAA credit rating) - they share that place with Microsoft!

Valuations

Conclusion

JNJ’s financial health, in connection with their ETF of a business, could make it a save heaven for income-seeking investors. For me, it offers too few opportunities to growth, and also, health patents expire eventually.

I’d rather buy MDLZ or UBER.

Buy, see you in the next one!