Bzzzz! You are a small merchant selling some of your branded t-shirts in Kazakhstan. You get a notification that someone has just bought one of your products. You run to the phone excitedly. The user has chosen to get their package from a Kaspi.kz Postomat, you print on a label and carry it to another postomat near your house. The money will be sent to you quite soon. And then you think to yourself, just what exactly is Kaspi.kz? Is it investable? Let’s find out!

For this stock analysis, we will use a company’s representative, I drew, Mark the Merchant:

Disclaimer:

Stock Information

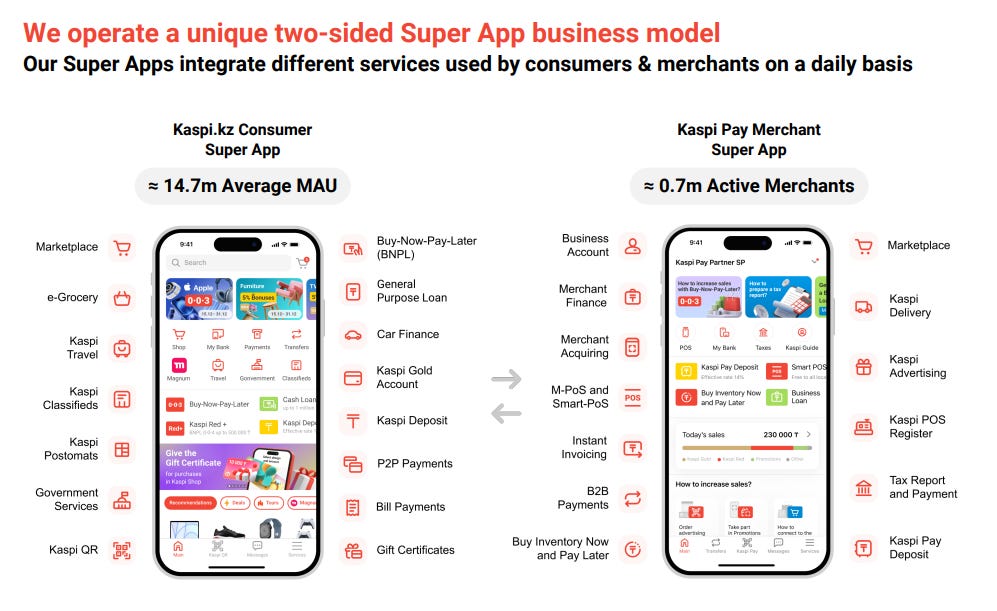

Kaspi.kz is a company which offers many services for its users in their Super App, like delivery of items, buying items online, fast person to person payments (usually under 6 seconds, similar to BLIK in Poland), deposits, lending money (often fast acceptation), travel bookings, postomats delivery (Similar to InPost’s package lockers, as well as Allegro’s One Boxes), as well as access to the electronic version of their state’s government functions, like singing of some documents, etc.

And that is all in one company! Unbelievable, isn’t it?

Here is a more detailed breakdown:

We can see that their offerings vary by the user, as if you are an entrepreneur and sell on their platform, you have different products which you can access than a consumer. I think that this makes sense to everyone. The thing about Super Apps is that once a customer is in it, they don’t need to install other apps, and even as they might only want to access some of their products, over time they can be upsold to access other features of their app, and some of them will likely do that, which is a huge advantage for Kaspi.kz, as it means that their users are essentially trapped in their ecosystem, similar to how Apple works.

They did mention that their Payments and Marketplace segments have higher profit margins, but they also mentioned that the E-grocery business, which they have entered into as a first-party provider (sole provider of food and delivery of food items), is a low-margin business—which might impact them if food prices go lower.

Here is their presentation (quite astonishing to see all of their metrics go up significantly over time).

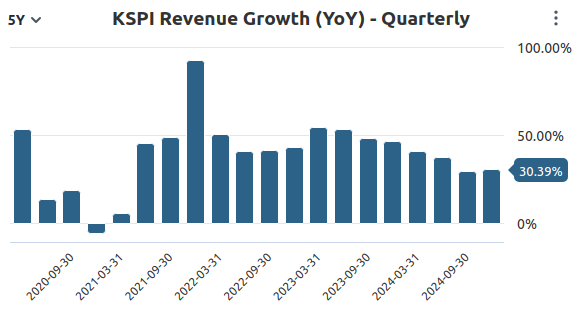

Many of their services are growing so quickly, thus resulting in a high gross margin, as economies of scale kick in. Also remember the fact that they reinvest heavily back into the business, for example, their Postomats, which have FREE delivery (yes it’s true), for all of their products that they sell across Kazakhstan made more people access their app. That is a great investment!

Look what they say about their approach to investing back into their business:

We are mobile-only and have developed our mobile technology with a view to distributing new releases and upgrades as soon as they are ready. This has become possible by investments in end-to-end automation and comprehensive test suites. Our technology is built to handle large amounts of data […].

Form 20 2024 Kaspi.kz

Their approach to users is simple: they don’t focus on Desktop users, only cater to mobile users, as they are on the go, and it’s always a better way to get clients, as they have their phones with them all the time.

We capture large volumes of data, which we use to power our artificial intelligence and machine learning algorithms and provide a highly personalized user experience.

Form 20 2024 Kaspi.kz

Similar to how Amazon works, by making personalised recommendations of which products to buy next, or how Duolingo makes A/B testing to check what resonates better with their customers.

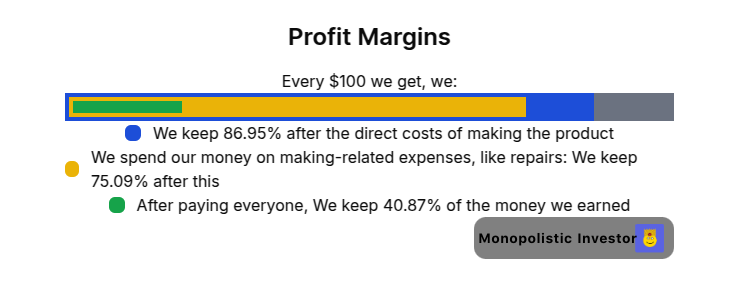

Here we can see the gross margin, operating margin and profit margin as a percentage:

I must say, up to this point, I’m very impressed by the financials of this company. Let’s see what their financial health says about them :)

What is Kaspi.kz’s financial health / Is Kaspi.kz financially stable?

This is their financial health, and I must say, I really like the fact that their balance sheet is healthy:

It’s just incredible! A company with a very strategic approach to its business is just superb! Not too much debt, and a reasonable approach to liabilities.

Many people, unfortunately, forget about the fact that the financial stability of a company is one of the most important factors in a stock’s analysis. Please don’t forget this in the future.

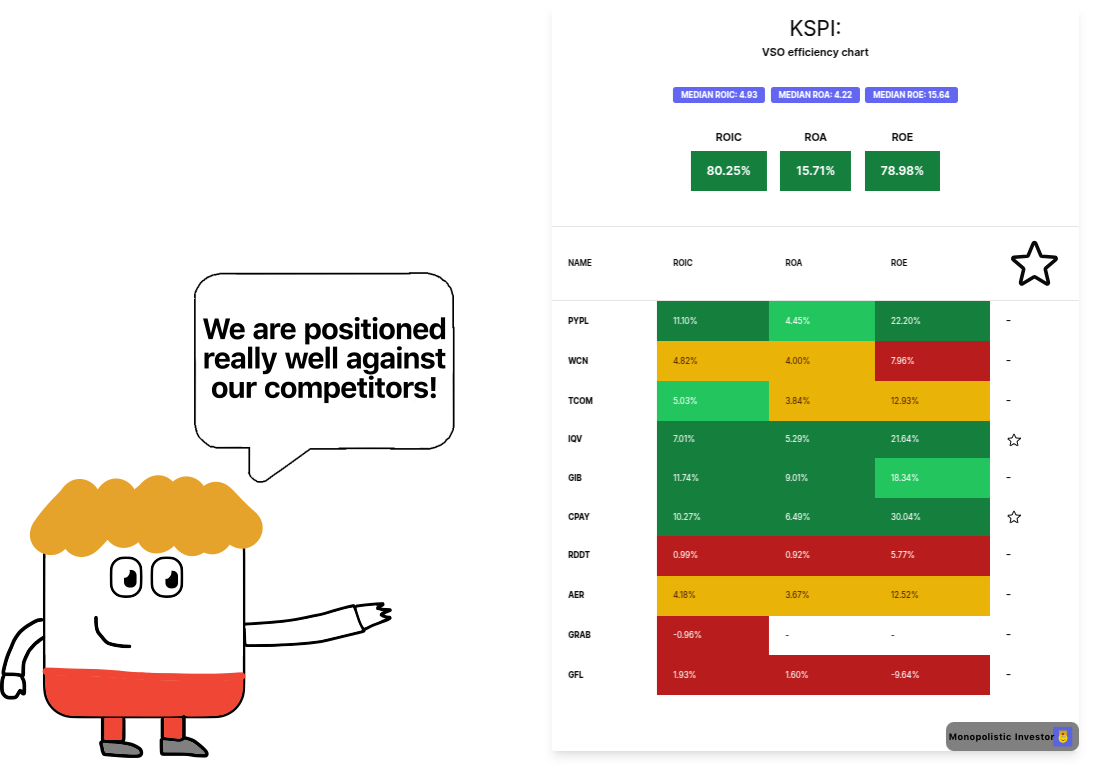

When we are comparing their financial efficiency metrics to other, similar companies, we get this:

I must tell you that they are a really great company if you look at this. Above the median compared to their competitors (look at IQV and CPAY, they are good as well).

Market share of Kaspi.kz (KSPI) / Is Kaspi.kz a monopoly?

Moving on, let’s check out their market share, as this is one of the metrics that is usually hard to find, but I made it simple:

Of course, not all of these companies are their exact competitors, but if we take a look at what their customers say in Kazakhstan, it’s a different story (in the positive aspect):

Even if we take other companies into the view, we can see that they aren’t significant, and given the fact that users like their current app, which is reflected in the numbers of total monthly active users, I can say that entering into this market may be foolish, if you don’t have a clear strategy on how to outcompete them. Amazon, of course, may try to underprice them and lose money to gain market share, but I mean, they’re so diversified that even if they were to lose their marketplace, they still have other services.

Emerging market opportunity vs danger of losing money in Kaspi.kz (KSPI):

While we can see that they have more room for growth. We can see that it doesn’t come at a cost, though:

Investing in securities of issuers in emerging markets, such as Kazakhstan, generally involves a higher degree of risk than investments in securities of issuers from more developed countries and carries risks that are not typically associated with investing in more mature markets.

20 2024 Kaspi.kz report

War, terrorism, regional conditions, natural disasters, inclement weather, health epidemics or pandemics, acts of God and other events that disrupt markets in which we operate.

(Note “acts of God” as an entry in their official 20 2024 form report) - Interesting. I have nothing against religion, and have a peaceful approach to other religions. I’m a practising Roman Catholic, and this is the first time I've seen the word “God” in an official document, but I’m ok with that.

Valuation of Kaspi (KSPI) / What is the fair value of Kaspi (KSPI)?

We need to consider a few scenarios:

Revenue doesn’t grow

Revenue grows at a 4% rate (slow)

Revenue grows at a 15% rate (much lower than their previous ones)

Based on this chart, I made my revenue estimate decisions. Here are the results (Please note that the $ sign is working. It should be KZT instead:

$164,18 (0% revenue growth)

$237,38 (4% revenue growth)

$602,05 (15% revenue growth)

Benjamin Graham valuation: $546,13

Benjamin Graham revised valuation: $314,18

Memes I made on Kaspi.kz (KSPI):

Conclusion:

While I do appreciate all of their achievements, I haven’t analysed them too much, but from what I’m seeing, it seems that they’re a stable and still growing company, so it’s still offering many investors an opportunity. The recent proximity of Russia worries me, and given the fact that Kazakhstan isn’t a member of NATO, it is also a red flag. Kazakhstan has a long history with Russia and remains heavily dependent on Russian energy resources, but it is a fully independent nation with its government.

Nonetheless, Kaspi is a very high-quality company, and maybe I’ll buy it at some point.