Nexstar Media.

Click! You turn on the TV, and as it plays the funny startup sound, you navigate to your favourite channels: ABC, NBC and FOX. Some advertising plays and then you wonder, what is the company behind it? The answer is Nexstar Media, which is affiliated with major networks like ABC, NBC, CBS, FOX, and The CW. What is their future outlook? Will Netflix and Youtube turn it into the next Blockbuster? Let’s see! :)

Stock Information

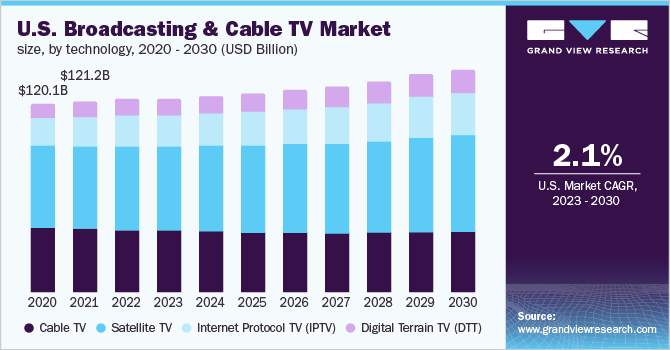

This is a company that owns and operates many different television stations across the united states, proving news and entertainment to a huge number of people, they have an exceptional presence in terms of local tv stations, as it owns around 200 stations in its portfolio in 116 markets, serving about 68% of U.S. households.

While competition from tech giants like Google, Apple and Netflix isn’t stopping, the management is confident about making the sports betting industry a bigger part of their revenue.

We all heard that Trump won the political elections in the USA, whether you like him or not, you can’t deny the fact that political advertising in the tv will still be around, as there are still millions of voters watching it.

They are said to be focusing on their core advertising, local digital advertising and agency services. Let’s not forget the fact that they are commited to shareholder capital return’s, by agressively buying back their shares, resulting in a buyback yield of 9.12%, with a dividend yield of 4.07%, with 25.19% dividend growth.

Return on Capital (ROIC):

7.74% ← Every $100 spent gives back $7.

Gross Margin 58.38% ← This means that for every dollar of revenue they generate, 58.38 cents are left over after accounting for the direct costs of producing their goods or services.

Operating Margin 22.19%

Pretax Margin 14.72%

Profit Margin 11.37% ← The metric we should give the most attention to, as that is what is left for the company after everything is paid (Employees as well).

Financial Health

I can’t highlight it even more. Liabilities and Assets are some of the most important metrics, and NXST is no exception here. Let’s have a look.

Based on this, we can have a good opinion on them, but let’s not forget about their cash to debt ratio.

Cash: $0.18B

Total Debt: $6.99B ⚠️

Net Cash: -$6.81B ⚠️

Debt / EBITDA: 4.08 (number of years to pay off debt)

Interest Coverage: 2.55 (how many times over can the company pay off their debt with earnings) ✅

Based on these metrics, I can conclude that this company is healthy enough for me to spread the word about my revolutionary drones.

Probably a Dr Robotnik quote

Revenue growth

Strong revenue growth for all the business expenses is what we need, let’s see what this TV provider has there. A reliable streak of revenue increases makes it a great investment, like Mr Krabs 2nd restaurant (pun intended) Ha Ha! :)

Ok, enough jokes, let’s see how this company is doin’.

Based on their recent revenue growth, all I can say is that it’s a little bit unpredictable. I would like it to look better.

Dividends

We can’t forget about dividends, as a famous man named John Rockerfeller said:

Do you know the only thing that gives me pleasure? It's to see my dividends coming in.

John D. Rockefeller

I made a quick scoreboard that shows you exactly how much, based on a 1-5 scale, does each dividend metric represent. Here it is:

We can come to a striking confusion:

This stock has the best dividend metrics I have EVER seen, and I’m not joking here, as Visa has 20% growth, but a small yield, Altria has 6% yield but slow growth, and others, whereas this one has a 9% buyback yield, this is just incredible! Maybe that’s why they have the mark as the 3rd best performing stock:

They have outperformed Nvidia:

But are they still undervalued? Let’s check their valuation…

Stock Valuation

We can see that it’s undervalued by 60%. That’s a lot.

Conclusion

Based on all this data, I wouldn’t be comfortable owning this stock, as for me, it’s in an industry that is too undpredictable because of media ginats like Apple, Google, Netflix and others. While I still think investors can be rewarded for owning this company, as they would be the beneficiaries of big buyacks and dividends, I need more time to have a look at this company, as it’s certainly an interesting one.

For now, if I has $1000, I would buy Adobe, ASML, Google and Uber.

But I don’t have, so that’s it. :)