PSA vs EXR.

Click! You open the door to your personal storage. Inside you find your family’s unique collection of long-forgotten stuff. It was all possible because of: Extra Space Storage Inc and Public Storage, which are companies operating self storage store across the United States. You look across the road. It’s Public Storage. You’re in Extra Space Storage. Just what are these companies? Let’s dive in, by analysing them, with a new newsletter look - enjoy!

Stock Information

We first need to know what are these companies doing, as some people might say:

“Pfff! Antoni, what’s there to understand? A simple company that rents out places to store your property. It’s as simple as that”.

No, it’s much more complex. What do these companies do in the first place? Think! I’ll wait. :)

First of all, these companies have to find a suitable area in which they want to build their facility. It needs to check a few criteria, namely:

Conveniently avaiable - so that they can reach their customers easily,

High-traffic areas - easier to find

Growing markets - areas not saturated with facilities, but ones that are empty of competition.

I totally agree. A storage facility not meeting these criteria is destined to be wasted. Like a bunch of cakes in the fridge.

Probably a Glengarry Glen Ross quote

Now that we know how they get their land, What do they do next?

They rent out professional developer teams, who build the facilities for them. After that, they rent them to you.

AND That’s their business model. It’s simple now.

Now, we can compare these two companies, in terms of their financial efficiency using a method I invented - a VSO chart ( Versus Others):

This chart shows the PSA (Left) and EXR (Right) stocks compared against their competitors, and we have the MEdians of ROIC, ROE and ROA on the top. If a stock has higher metrics than the median, it highlights this cell green. If not, it uses the color red.

We can cleatly see that EXR and PSA are among the stocks in their industry, which are highlighted green. That’s a positive signal for us. We can see that PSA has overall healthier metrics in terms of financial efficiency than EXR. Let’s keep this in mid. PSA has a tick! :)

Financial Health

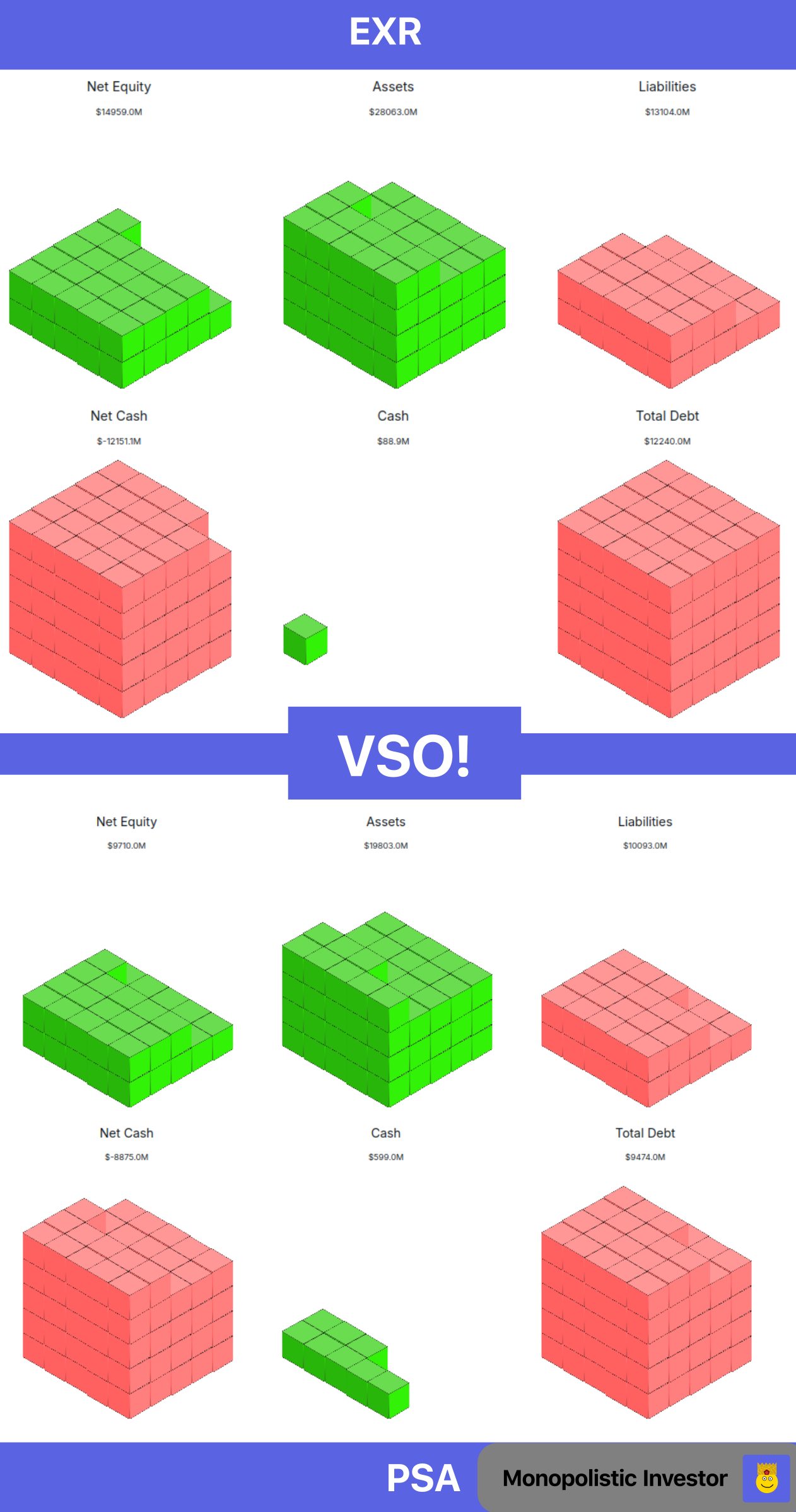

No stock analysis can be completed by omitting this how crucial step. We can compare these two companies based on their assets, liabilities, net equity, cash, net cash and debt, by looking at a cube diagram that I myself created (I’m a programmer) in a VSO chart:

We see a typical situation in REITs (Real Estate Investment Trusts) - where the debt is many times more as their cash. (That’s because they have loans on their facilities). They both have a positive net equity, which is a really important factor, as it makes it easier for them to get loans and to aquire smaller companies, but not only, as a positive Net Equity indicates that the company is healthy, and doesn’t need to worry about paying off their debt as much.

In this category, I see mostly a tie, although PSA has more cash proportionally than EXR, but has a smaller net equity portion proportionally, so in this case, I would choose PSA (If I had to).

If you have any ideas on how to show complicated stock metrics easily, let me know, and I’ll try to create it! :]

Revenue growth

Let’s compare those two companies, and see which one is doing better!

As a business that has actual revenue growth, will prosper compared to an unprofitable machine like Spirit Airlines.

Let’s check out my VSO chart:

In connection with:

It gives us a very clear picture of their income statement, as we can see that EXR (being the smaller company of the two, its market cap sitting at $32.67B, compared to PSA’s $52.35B), had a spike in revenue, and their revnue has also been all over the place, similar to PSA. If we look at their profit margins, we can see that at the end, PSA has a higher profit margin (40.37%), compared to EXR (24.41%), so you can see that PSA has a 2x profit margin that EXR has. Brilliant! :)

DIvidends & Buybacks

We all want that extra bit of cash to spend on more stocks. REITs have a stupid law, in my opinion, that they HAVE TO give away 90% of their earnings to their shareholders, so don’t focus on their yield alone. Look at their payout ratios: EXR (170.01%) and PSA (124.49%) - I’d rather choose PSA’s ratio. I don’t like REITs.

They have more or less the same dividend yield (4%).

PSA better.

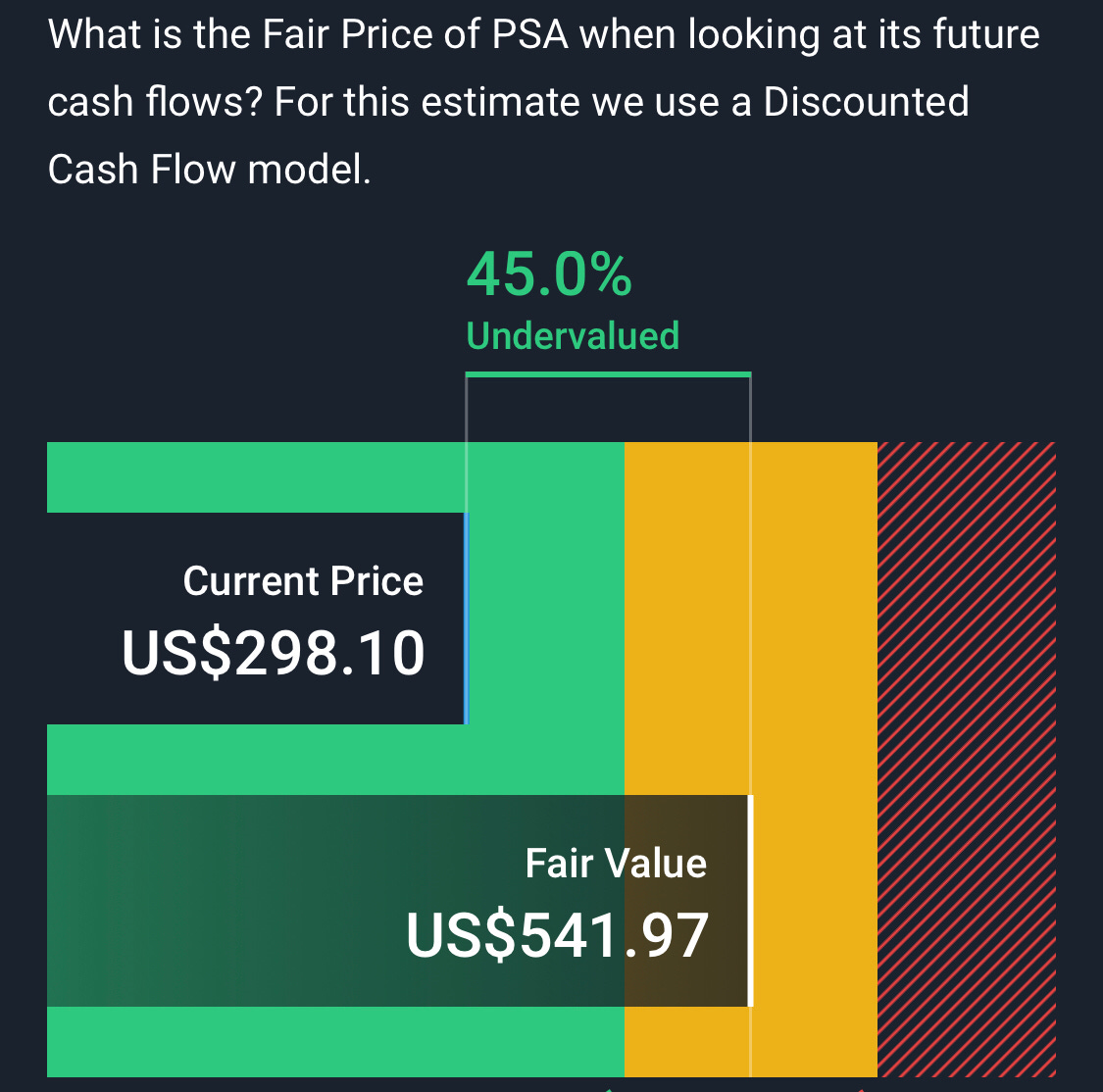

Valuation

We can see PSA is more undervalued.

Market Share (new!)

My newsletter isn’t named the “MONOPOLISTIC Investor” for nothing - I want the ultimate companies in my portfolio.

Let’s look at their market share (also generated by my tool):

(I had to cross out a few stocks, as they aren’t their true competitors (ie. not in the storage REIT sector).

We can see AMT has the biggest market share out there. None of the stocks we’re analysing here tick the box. :(

Conclusion

While I can see the usage of this business, I’m not comfortable with holding a REIT - a company that is sensitive to any interest rate changes.

I won’t be buying any of them, as I see better opportunities elsewhere.

Thanks for reading, if you have questions, don’t hesitate to ask! If you have any ideas on what sort of stock-metric related charts I should add here, let me know!