S&P Global.

Vroom! *radio sounds* You are bored on your way home from work. You open up YouTube on your android phone, watch some random guy drone on about the latest stock ananlysis. Guess what he says in the video? “Comparing this stock’s performance with the S&P 500…”, wait, wait, Wait! Just what exactly is this? S&P 500? What is the company behind this? S&P Global, a leader in market research. And guess what? It’s one of the most boring businesses on earth, which is exactly what I’m looking for! A boring company can be a great investment, but an exciting company doesn’t have to. Let’s check it out! :)

Stock Information

What exactly is SPGI doing? Everyone knows them from their indicies business, but they also do credit rating scores for companies, not individuals, like FICO, which makes their moat more resilient to government scrutiny. Credit ratings are sort of like the TrustPilot stars you sometimes see on websites, but for businesses, so that the Big Boys (aka Banks, and Asset managers, I see you, Blackrock), can quickly check whether it’s even worth doing business with you.

So, what we have here, exactly?

An Indices businesses - making lots of cash from licences that are coming through from clients worldwide, as indices are used as benchmarks for many, many products: ETFs, hedge fuds and more.

Market Intelligence - a subscription-based software giving investors access to HUGE amounts of data, investment professionals, corporations, and governments all use this, and thanks to S&P pricing power, the clients will pay any price to get this. Bingo! Ka-ching!

Ratings - revenues from this segment can be a little bit more subject to change, depending on the economic environment, but the rating offered by S&P Global is recognized all around the world (Exactly like VOO, says a Bogglehead) - ha ha! :), this helps investors a lot, as it makes it easier to asses an object’s financial health.

Let’s move on to their financial health…

Financial Health

If a business is of good quality, it has a small amount of liabilities and huge amounts of assets.

Antoni Nabzdyk

A business with lots of debt is like a pile of homework that is put on top of a student, even when he has to go tomorrow for 7:20 in the morning for school.

We don’t want that. It worries and makes us nervous.

So, let’s just have a quick look at S&P Global’s health:

What we see here is a great example of a balance sheet!

Stock Revenue

While we want our stocks to have excellent balance sheets, we can’t forget about the fact that all businesses need to have sustainable and predictable revenues. Take Microsoft, Google and Nestle.

We need that kind of stability, but can we find it here? Check this out:

Their net income is a bit chaotic, but generally, you see an upward trend. Good! :)

Stock Dividends

Who doesn’t like an occasional cent on the ground? Well, here we can get lots of small change frequently! And, you don’t need anything except some cash to get it! Here’s my take on it:

Not the best situation, but still, cash is cash right?

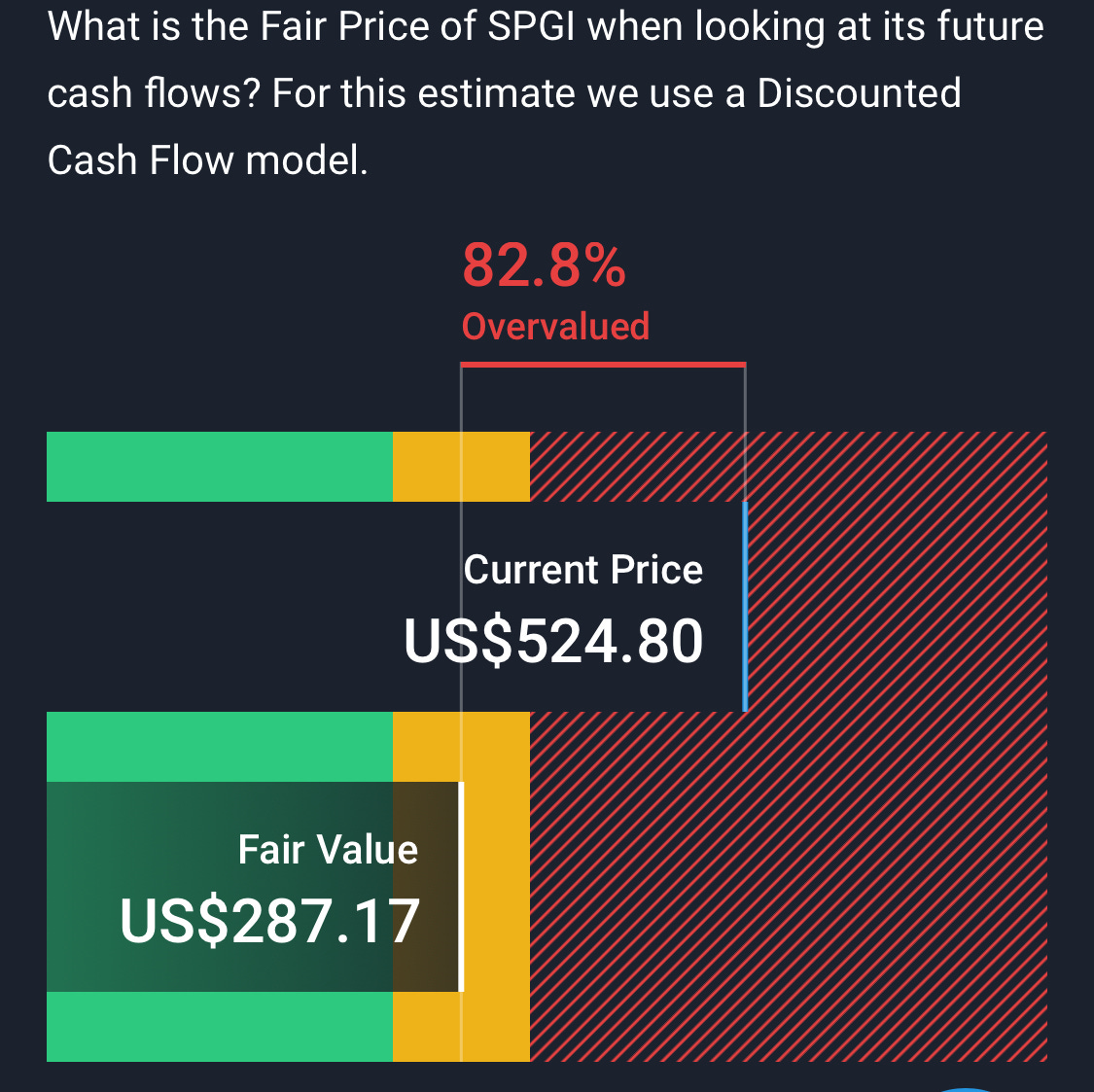

Stock Valuation

I won’t be buying this anytime soon.

Conclusion

While this company can certainly offer you one of the best moats in the world, a dividend which is growing slower than inflation and high valuation, make this company a hold for me.

Psst! On Saturday and Sunday (26-27 Oct), I will be selling my own t-shirts, which my brother made, at the MTP Poznań Hobby fair in Poland. Check out my new youtube channel here: https://youtube.com/@sketchthreadofficial-f1r?si=xh1QKFw1mf4yHzyd

Background image by:

https://unsplash.com/photos/a-tall-building-with-a-clock-on-the-side-of-it-QmRG3ZZvT9E?utm_content=creditShareLink&utm_medium=referral&utm_source=unsplash