Beep! Beep! Beep! You are a small grocery store owner, and while patiently waiting for your truckload of food to arrive from a company, you can’t help but wonder: What is their business like? What are their opportunities on the horizon? That company is Sysco, not Tesco, and let’s see whether this company is what you might need in your portfolio! Let’s go! :)

Sysco Stock Information

A disclaimer:

Remember to always consult with a professional financial advisor. These are all opinions of my own, and you shouldn’t follow them blindly.

For this analysis, we’ll get the help of our friend, called Fresh Food Frank, from Sysco:

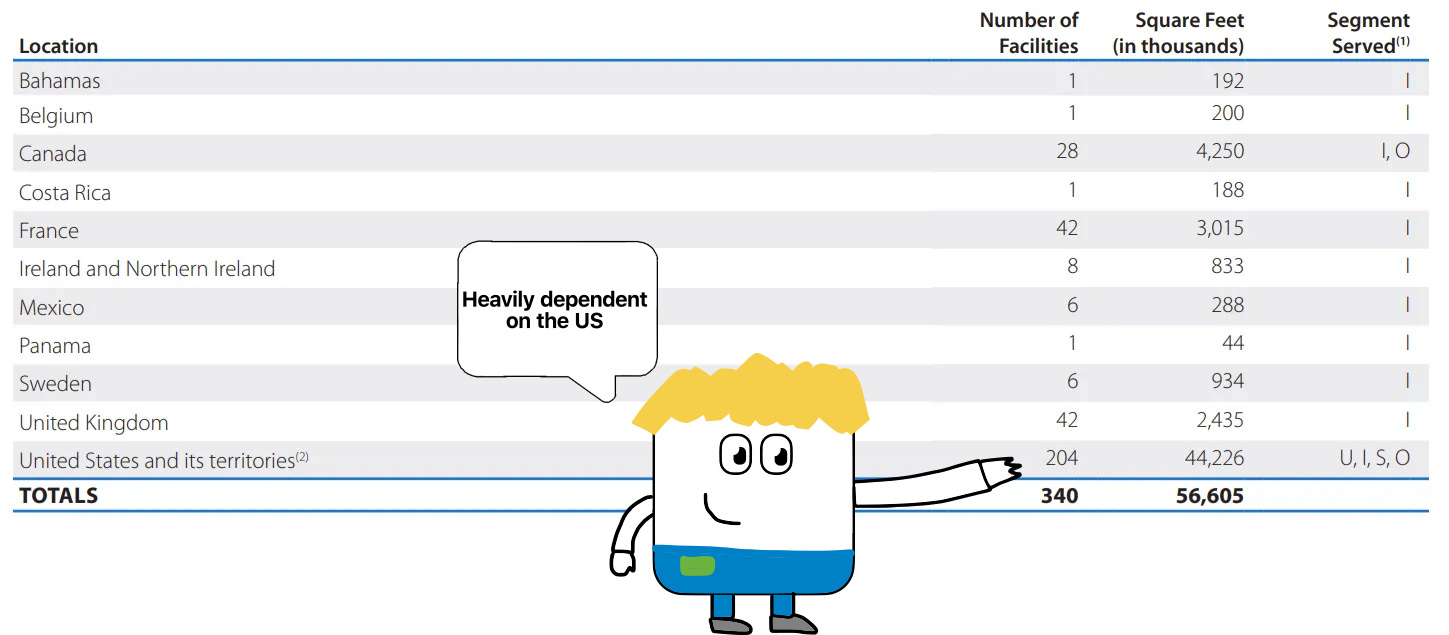

Sysco is a company that operate sin the distribution of food mainly in the US and Europe, by making sure that low prices, high quality, and great customer support translate to better sales.

Their business features steady demand, and doesn’t fluctuate on a typical basis, for that reason I chose to analyze them, as I was influenced by one YouTuber, who said that boring businesses are the best. Let’s take that to the test.

They mention that customer switching costs are low, which might mean some potential to be disrupted by Grocery stores or wholesalers like Costco, but I do think that an important aspect is overlooked here. Companies which source their products from them are used to them so why would they switch?

Their business is heavily regulated by the FDA (Food and Drug Administration), as to what to include on the packaging, the nutritional information, as well as to accept all sorts of safety precautions necessary to operate. Local health agencies may also inspect their facilities to see how they prepare the products. Because of all of those reasons, and to meet the expectations of their demanding customers, Sysco has teams of people who are monitoring the manufacturing process of the food that they are selling.

A risk that Sysco has is the low margins that characterise their industry. Prolonged inflation or deflation can impact them negatively.

A small component of the barrier to entry, which we are all looking for as monopolistic investors, is the locations of physical distribution centres. That is a large cost of entry for newcomers in a similar market. That’s a positive aspect. Food and safety precautions may also scare off competition, as it’s frustrating for small entrepreneurs to start even a small restaurant.

Looking at what they do to source local produce like meat, chees,e and others to support thecommunities is also an overlooked factord. Once a small farmer collaborates with them, he isn’t going to switch easily, as he is used to selling to them and just wants to sell quickly.

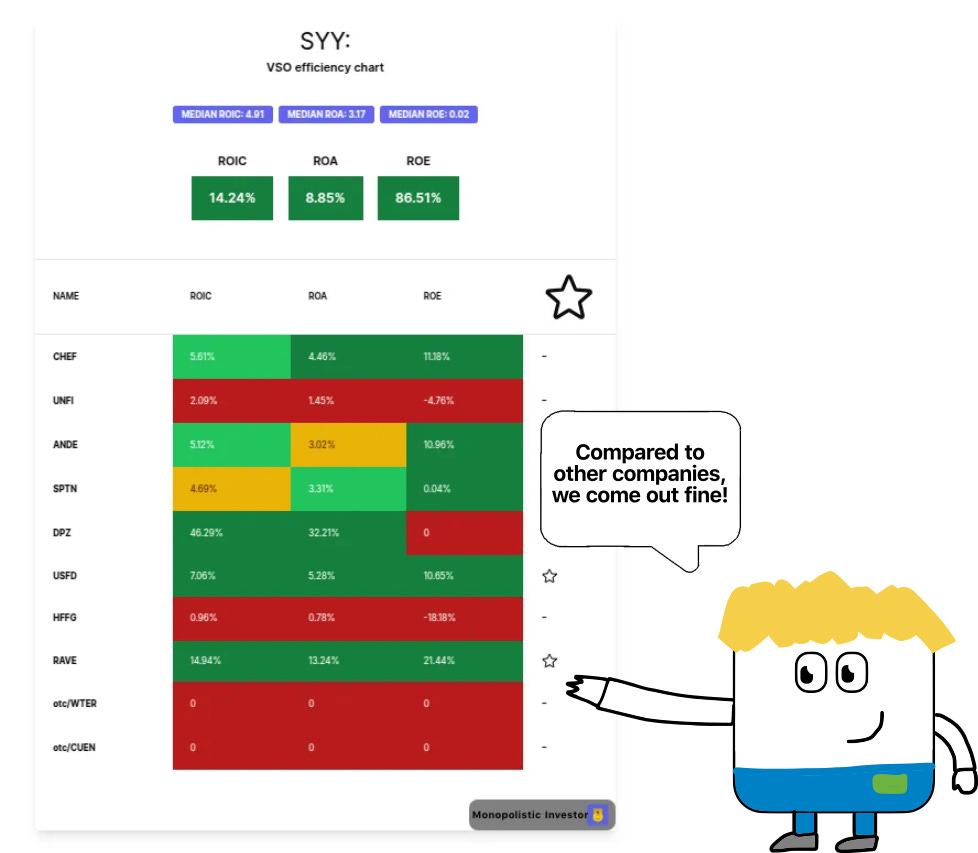

What is Sysco’s financial efficiency? How profitable is this company?

Their overall profitability improved over the past year (2023/2024, based on their 10-K report), as we saw their net earnings increase 10.5%, which shows that they are taking the necessary steps to grow their financial efficiency. We can see that their overall revenue represents a small percentage, only 3.3%, which they attributed to inflation, volume growth and acquisitions. We can see that while they haven’t increased their overall sales, their efficiency is quite good:

This comes from my tool, MarketVision, which is avaible to all paid subcsribers. We can see that compared to other companies, Sysco is great at managing their finances, but we can see that RAVE and USFD are also interesting companies to look at. That tool shows you exactly how much below or above the median a value is (colour-coded).

Now let’s move on to the financial health category…

What is Sysco’s financial health? Are they a safe company in terms of debt?

I think that many people treat stocks as lottery tickets, paying only attention to the logo, name, and whether the price goes up or down. That couldn’t be further away from the truth of what investors truly do. I think that this meme clearly illustrates it:

That’s why I chose to make it easier, here you can just quickly look at a stock’s balance sheet, and instead of looking at the numbers, you get a nice chart of them:

We can see that their net equity is on the positive side, with a bit of a reserve left, however their net cash tells a different story, probably due to their recent acquisition of Campbells Prime Meat, in Scotland, which will provide them with even more local power.

So their net cash is on the negative side, but we’ll see whether it goes down in the next quarters.

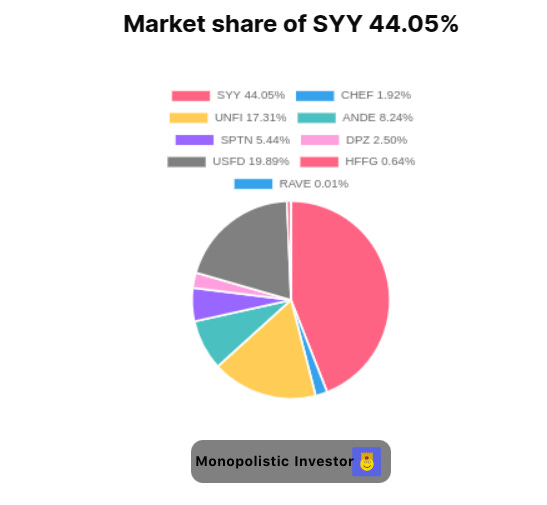

Who are Sysco’s competitors? What is Sysco’s market share?

According to my calculations, Sysco’s presence in the food distribution segment is around 44%:

That’s a great thing, as it can mean a more peaceful mind when owning this company.

What is Sysco’s fair value? Is Sysco undervalued right now?

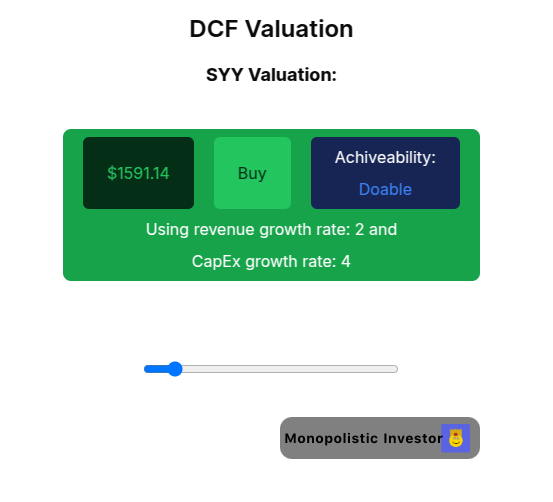

No one wants to overpay for a company that they want to buy. One of the simplest, yet most effective ways to do that is the DCF method, which takes into account the future growth of the revenues of a company. I will be adding more features to the app, like a varied CF valuation tool, but here’s the DCF:

We will take a few scenarios (realistic one - 2% revenue growth):

If we take a look at their most recent revenue growth history, we can see a company that is growing in the low single digits (2-4%), so taking a very conservative outlook, we will estimate 2% growth:

We can see that with a revenue growth rate of 2% and a CapEx rate of 4%, we come to the DCF valuation / fair value of $1591.14

Pessimistic scenario (0% revenue growth):

If Sysco’s business were to stagnate (an unlikely, but possible scenario, we would have to face the tough reality: 0% rev. growth):

Based on the growth rate of 0%, we come to a valuation of $1304.07.

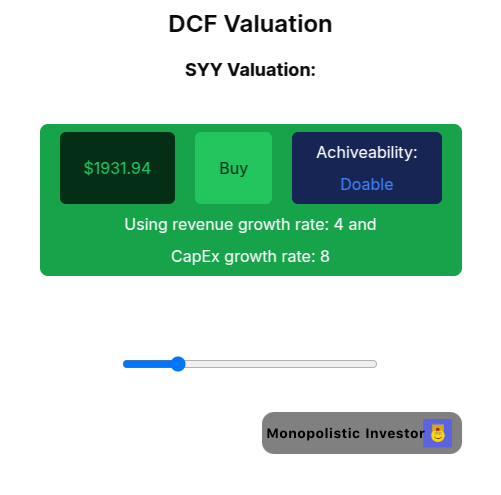

An optimistic scenario (4% growth):

And based on a revenue growth rate of 4%, we come to the valuation of $1931.94

Conclusion of Cysco / My opinion on this company

Sysco is a great company, no one can argue that, but the sheer amount of CapEx needed to expand their operations, the hugely competitive nature of the business, as well as low switching costs for the customer don’t make this a compelling investment for me. Management said themselves that their customers have low switching costs, so that makes me cross out that stock immedietely.

People who like 2% dividend growth may be happy, but I’m not one of them.