Vroom! You pull up on your local gas station. A quick glance at the station’s logo says it’s Chevron. Walking to the store’s entrance, you think to yourself, where exactly does the fuel come from? The answer is Texas Pacific Land Corp, a lesser-known company, mostly hidden from the flashy AI companies here and there. It’s quietly grinding in the shadows, leasing its land as an owner of oil lands in Texas. The stock has been like a rocket YTD, soaring over 206.05%, and it’s a boring “Oil & Gas Exploration & Production” company, which is supposed to be unpredictable, right? But no, they’ve somehow got the right elements of the business right, and today, we’re going to discover, what exatcly did they do right, and what will the clean energy transformation mean for this good ol’ Texas company. Let’s get into it!😊

Stock Information

As Warren Buffet once said:

"Don't invest in something you don't understand."

Warren Buffet

So we won’t start investing into a company, before we don’t get to know the company really well. That is often overlooked these days. What a shame! Doing DCF valuations is an interesting excercise. (I like maths and programming, so if you don’t…)

That’s what you feel like, right? :) But enough of that jiggery-pokery, let’s look at what this company is actually doing:

TPL (That’s what I will refer to from now on, as it’s tiring to type the same four words over, and over again), is a large landowner in Texas, especially in the Permian Basin, which makes money by:

Leasing it’s land and getting fixed fees from it

Selling water and treating wastewater from oil production

Each time someone producs oil on their land, they get a small part of it (Royalties)

No active drilling operations, thus making it a safer investment.

Interesting! So a company which owns the land on which the drilling is happening, and they basically are the blueprint for success, as in the oil dicovery business, you usually have to spend lots of money upfront, and after that, you wait to get your money back, and THAT’s ONLY if they find oil, whereas in this situation, if a company comes in, drills for oil, and doesn’t find it, TPL shrugs their shoulders, and says: “You paid for the use of land”.

What’s even better is that this is a long-term focused investment, looking for strong recurring revenues, derived from their land leasing. Even as certain projects come and go, they are a company that is extremelly well positioned to capitalise on the ongoing demand for oil.

Ok, but now come the realists:

Antoni, what about the renewable energy? Are they investing into that? Well, they are collaborating with certain oil and gas companies to reduce their emissions, and allowing developers to take advantage of wind and solar panels on their land, so I guess they’re taking some small steps towards it. I wouldn’t be worried about that, though, as the world runs on oil right now. Look at this chart:

They still have a long way to go, and thus, for at least 20 years or so, you can own this company with a piece of mind, but even after that, I do suspect that they will transition to a water powered electric plant (as they sell water), wind farms (they own huge amounts of land) and maybe even nuclear energy, but that’s only my guess.

Let’s have a look at some of the most important metrics for any investment: ROIC, Profit margins and market share.

ROIC: 32.87%,

Gross Margin: 93.27% (Visa’s 97.83%) - The direct form of revenue mius costs of goods.

Operating Margin: 77.32% (Visa’s 66.63%) - Gross revenue minus costs of production (cars, maintenance, tools, pcs)

Profit Margin: 65.34% (Visa’s 54.95% ← Smaller than TPL! 😂) - After all expenses, here is what the company has.

We can see a tremendous profit margin. You don’t see it often. Why am I comparing it to Visa? Well, beacuse Visa is also a high-margin business and it’s also a really hands-off aproach, which is very similar to TPL.✅

Alright, now let’s proceed to their position in the market.

Upon looking at this chart, we can see that TPL is the 7th biggest player on the stock market, and calculating this:

748.47B (Whole sector market cap) / 36.76B (TPL market cap) = 20 = 1/20 = 5/100 = 5%

Financial health

If a company is in good financial health, we can be almost certain that it won’t go bankrupt (I see you, Spirit Airlines 👀).

I created a visual representation of the assets vs liabilities of the company (Click the image below to access it):

So we can see their assets are at $1.18B, while liabilities are at $0.06B, which brings the net equity to $1.05B.

Let’s look at their net cash to debt ratio:

Debt: $0.953m

Cash: $533.91m

So we have a very healthy company indeed.✅

Revenue Growth

We want our company to have fast revenue growth, shwocasing its pricing power and innovative business practises. Let’s delve into their financial statement:

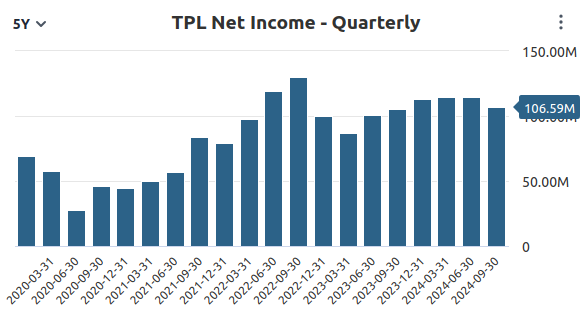

As we can clearly see, they saw some revenue acceleration a few years ago. Right now, we have some sort of stagnation in that space, but let’s look at their net income, as this is what they get from the revenue as a company eventually:

Same situation, but because of the high operating and gross margins, IO’m not concerened about them being able to turn a profit.

Revenue growth: OK 😐

Dividends and buybacks

A really important driver in terms of the total returns, let’s see how they reward the patient shareholder (click the image below to access the chart, showing their dividend metrics):

They had a special dividend, so that would make their dividend growth at 62%, but that wouldn’t give the realism of the situation, the realistic growth would be around 8%.

Their buyback yield is a really low 0.29%, signalling that the management doesn’t consider buying back their stock as the best investment (but insiders are buying, so I guess it’s a bulllish sign, but don’t take this for granted).

Valuation

We want to get the best price for our money. Let’s see if TPL is over-or-undervalued:

Conclusion

TPL is a very high quality company, I analysed it a few months ago. It cost $700 then. It also showed up as overvalued. I guess it’s going to be like Costco - a company with much momentum, with no signs stopping it. If it crosses $3000 per share, I wouldn’t be surprised, although to buy right now, I wouldn’t be too calm about it, I’d rather buy it at a lower price, and also, the geographic concentration is a good thing on one hand, but on the other, if something goes wrong, well, it’s FIN (an author saw a shark before his death and that’s why I guess they say this).

I will still keep this company in my watchlist, but for now, I rate this company a hold, thanks guys for reading, see you in the next one! :)

hello, with a bunch of investors wanting to short oil price, $3000 might be too optimistic?