Beep! You turn on the computer. A computer monitor buzzes to life, by flickering and showing your login screen. The silent humming of the computer prevails in the quiet room. You own a Dell Computer, with an AMD architecture, but what you don’t know is that hidden from sight, is a small chip that was produced by a company you didn’t know had a significant existence: TSMC. Oh, and also, you love that high speed wifi connection, which is silently provided by AVGO or Broadcom, which makes the wifi cards in your computers. The thing is, as an investor, you need to choose your next investment, so, which of those will you pick? TMSC or AVGO? Both or neither? This will be a guest post with Tech Tornado's newsletter, so check out his publication as well! :) Strap in for a ride and let’s start!

Monopolistic Investor Part (TSMC):

Stock Information

First and foremost, every investor must carefully understand a business before he invests in it, by following Peter Lynch’s principle of “investing in what you know”. This is the case with TSMC, which is a place where you have clients come in and say

“What’s up folks! I hve this idea for a computer chip. Can you make it for me?”

TSMC is on the job for just that, by putting its customers first. There are many other companies in the same industry, which are competing for the same customers, but that doesn’t stop the management from putting its goals straightforward:

“[…]1. Be a technology leader, competitive with the leading IDMs

2. Be the manufacturing leader

3. Be the most reputable, service-oriented and maximum-total-benefits silicon foundry”

2023 Annual TSMC earnings report

They are commited to growing their 5 business segments:

High Performance Computing (HPC), as they are mentioning the rise of data centres, as a key driver in expansion of their business

Smartphones, which are a key part of consumers’ lives,

They want to enhance chip performance, reduce power consumption, and decrease chip size for its smartphone customers

Internet of Things (IoT): all sorts of devices, like smart home speakers, thermostats etc, etc are made with the motto of “everything connected, smart and green”

Digital Consumer Electronics (DCE) - TSMC wants to provide its customers with Smart TV technologies.

Automotive, which links many of TSMC strengths together, “safer, smarter and greener”

Other than that, they are keen on developing leading-edge technologies at a reasonable, and predictable speed to achieve better energy efficiency for its products.

Solid, right?

Well let’s chek out their market share, as this is one of the most important factors in determing whether a stock is worth anything, using the tool I developed myself, showing a basic pie chart:

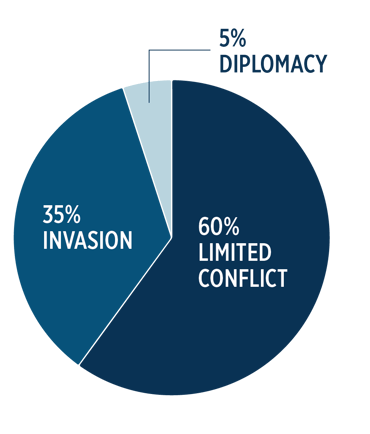

We can see that they have a MASSIVE market share. WOW! To the moon, right? - A gen Z investor would say. Not so fast, we need more information. Like the earthquakes and political danger:

I read an article on that, stating that the most likely scenario is a blockade by the Chinese of transport between Taiwan and the rest of the world, which could add some pressure to global trade, as well as to companies like TSMC, which are heavily reliant on Taiwan, with only a few foundries beyond its boundaries. I don’t trust the Chinese government, as its communistic approach is bad for our capitalist-mindset. What if they leave the foundries intact, but take control of the company, not taking the SEC appeals? This is the only danger that Chinese stocks have apart from the US. I recognise Taiwan as an independent country, however.

Moving on to the VSO efficiency chart, which I made uing my tool (I’m a programmer), with the green areas above the median metric and others below it:

We can see that TSM has strong financial efficiency metrics, showing the incredible powerhpouse that they have as a company. That’s a very positive thing.

Check out NXPI, HUBB, UI and VRT stocks next, as they are also posing an interesting analysis! :)

Let’s look at their profit margins (also made using my tool):

We can see a 56% gross profit margin, and a 40% net profit margin, showing us a company with very good pricing power! That makes me very happy!

Let’s go on to the financial health:

Financial Health

The most important section (apart from the market share, you have to read!).

The financial health cubes, which you are going to see in a moment are made out of 125 blocks, each cube being proportionally divided, and some hidden, so that it reflects the real proportions between the values, red mean negative values, and green positive. AND they have been made using my own tool:

A net equity position and a net cash position are what all of us investors want, right? Yes, that’s exactly what we need! Their Debt / EBITDA ratio is at 0.5, meaning that off their earnings, they could pay off all of their debt in 6 months! (amount of years = 0.5). If you have any ideas on how to show complicated stock metrics easily, let me know, and I’ll try to create it! :]

I’m pleased with the condition of this company. Let’s move on to the revenue growth:

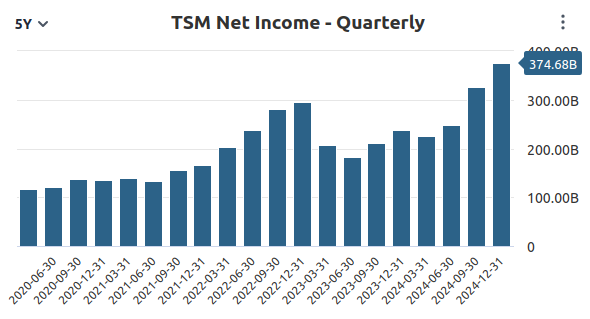

Revenue growth

All good companies have pricing power, enabling them to rise up their prices of products easily. Does TSMC have that ability?

We can see pretty healthy revenue growth, given that they are in a very cyclical industry, much like oil aned gas companies, but this leaves us with a potential opportunity to buy it.Incredible growth here: basuically double digit growth year-over-year. Their net income is also growing steadilyt over the past few quarters. Good work!

Valuation

Nobody wants to overpay for a stock. That’s why I have created a simple tool to find out, whether this company is worth buying, using a FCFF valuation:

Using a growth rate of 15%, we come to the conlusion that they are worth $4114. Why? Because of their opertaing margin, and revenue growth. If you want to be more conservative, and choose a growth rate of 4%, we will come to a conclusion of

It depends on your risk tolerance. Both options look fine to us.

Simplywall.st:

A lower price target. For us, both show significant upside. Wow! :)

Conclusion

Buying this company does in fact make sense for some people. I’m not in this bunch of people, however, as I’m too worried about the fact that they are located in Taiwan, and I don’t trust the Chinese government, if it were to take over Taiwan. This company is also a little less of a monopolist than ASML, which is the only option out there for EUV machines, but of course TSM is in a totally different segment, however, customers have more room to say no to such a company, that’s why I don’t want to buy them, but that doesn’t mean YOU shouldn’t. In fact, apart from these issues, I don’t think that people buying this company will do bad, maybe they’ll even outperform the market, but everyone has a different financial situation.

This isn’t financial advice.

Tech Tornado’s Part (Broadcom):

Broadcom (AVGO) – A Strong Business, But an Overpriced Stock? A Deep Dive Analysis

Broadcom (AVGO) is one of the most dominant players in the semiconductor and software industry, benefiting from its strong positioning in networking, cloud computing, and enterprise infrastructure. With the $61 billion VMware acquisition, Broadcom has expanded beyond hardware into high-margin enterprise software, diversifying its revenue streams.

However, while Broadcom’s fundamentals are strong, its valuation looks stretched. The stock price reflects near-perfect execution, and any disappointment—whether in AI demand, software integration, or customer concentration (Apple)—could trigger a sharp correction.

This analysis covers Broadcom’s business model, revenue drivers, financials, risks, valuation metrics, and my investment thesis.

1. Business Model & Revenue Streams

Broadcom operates in two major segments, blending high-performance semiconductors with enterprise software, creating a unique combination of growth and stability.

A) Semiconductor Solutions – 73% of Revenue

Broadcom’s semiconductor division specializes in high-performance chips used in cloud computing, networking, wireless communications, and AI computing.

📌 Key Revenue Drivers in Semiconductors:

1️⃣ Networking & Data Center Chips (~30% of revenue)

Leading supplier of switching, routing, and connectivity chips for data centers.

Major customer base includes hyperscalers like Amazon, Microsoft, and Google.

AI-driven tailwind: Custom ASICs (Application-Specific Integrated Circuits) for AI workloads.

2️⃣ Wireless Components (~20% of revenue)

Apple dependency: Broadcom supplies RF filters and connectivity chips for iPhones, accounting for ~20% of total revenue.

Risk: Apple is reportedly developing in-house alternatives, threatening Broadcom’s long-term wireless business.

3️⃣ Custom AI Chips & ASICs (~15% of revenue)

Broadcom designs custom AI silicon for hyperscalers, focusing on infrastructure optimization rather than general AI computing.

Key Difference vs. NVIDIA: Broadcom enables AI infrastructure, but it does not dominate AI training chips like NVIDIA does.

4️⃣ Broadband & Storage Chips (~10% of revenue)

Storage controllers for HDDs, SSDs, and fiber-optic networking.

Key enabler for enterprise cloud and storage solutions.

📌 Conclusion: Broadcom is not a pure AI play like NVIDIA but a critical enabler of cloud and networking infrastructure.

B) Infrastructure Software – 27% of Revenue

With VMware’s acquisition, Broadcom is pivoting toward enterprise software, aiming for higher margins and recurring revenues.

📌 Key Revenue Drivers in Software:

1️⃣ VMware (~15% of revenue)

Market leader in hybrid-cloud and virtualization technologies.

Expands Broadcom’s business into enterprise SaaS and cloud security.

Stable revenue model but slower growth vs. semiconductors.

2️⃣ Mainframe Software (~7% of revenue)

Solutions for legacy IT systems in banks, insurance, and enterprises.

High margins but limited growth opportunities.

3️⃣ Cybersecurity & IT Management (~5% of revenue)

Enterprise IT automation and security solutions via previous acquisitions (Symantec Enterprise Security).

📌 Conclusion: The software division reduces Broadcom’s reliance on cyclical semiconductor sales, but its growth rate is significantly lower.

2. Financial Performance & Valuation – Is Broadcom Overpriced?

While Broadcom continues to grow strongly, its valuation appears significantly inflated, raising concerns about future returns.

📌 Analysis:

Sales growth falls rapidly below 15% after 2024 - difficult basis for the high valuation.

Net margins are rising, but this is already priced into the share price.

Bewertungskennzahlen – teuer bewertet

🚨 Red Flags:

EV/Sales of 16x – double the industry average (~7-8x).

EV/FCF of 43.6x – too expensive relative to free cash flow.

📌 Conclusion: Even with strong future growth, Broadcom's multiples are not sustainable – especially if AI demand slows.

3. Risks That Could Trigger a Sell-Off

While Broadcom is a well-run company, several key risks could jeopardize its valuation:

1️⃣ Apple Dependency – If Apple develops in-house RF chips, Broadcom could lose ~20% of its revenue.

2️⃣ AI Overhype – Broadcom’s AI exposure is indirect – it does not sell the leading AI training chips like NVIDIA.

3️⃣ VMware Integration Risk – Enterprise software growth is slow, and execution risks remain.

4️⃣ Market Correction – If interest rates rise or AI enthusiasm fades, high-valuation stocks will suffer first.

4. Final Verdict – My Price Target & Investment Strategy

Broadcom is a great business but a risky stock at this valuation.

📉 12-Month Price Target: $200

EV/Sales of ~10-12x instead of 16x.

Attractive entry below $170 per share.

🚨 Investment Recommendation:

✅ If you own AVGO → hold

✅ If you want to buy → Wait for a market correction before entering.

💬 What’s your view? Is Broadcom overvalued, or does it still have room to run? Let’s discuss! 🚀📉