Verisk.

Click! You are the owner of a large and established insurance provider in the US, and have a usual busy day at work. Once in a while, a worker comes up to you with some sheets of paper, saying that the new report has just come out. You look at it, and get insightful data on the weather forecast, and some risks associated with insuring old homes. Based on this, you can make more informed decisions in your company. “Alright, everyone, let’s introduce a new product!” - you say. The room falls silent. Only a faint air conditioner is humming. You look at the paper again. A small logo in the left-hand corner of the front page looks back at you: Verisk. But what exactly is this company? Is it investable? Let’s find out! 🙂

For this analysis, we’ll use the company’s cartoon representative, Vern the Verifier!

Stock Information

Verisk is in the business of providing analysis of insurance offerings that the top 100 Property & Casualty insurers sell. Imagine you are such a company. It takes a lot of effort to do the risk analysis for the products you offer, and as an insurance provider, you want to retain as much cash as possible, right? You don’t want to spend time overthinking a product - you need to ship it! That’s where Verisk comes in - they can analyse billions of records on insurance data and create projections, products in many forms that can be used to aid workers in decision making. That’s helpful! Due to the high level of regulation of the insurance industry in the US and its expertise in it, Verisk is the go-to solution for many insurance companies.

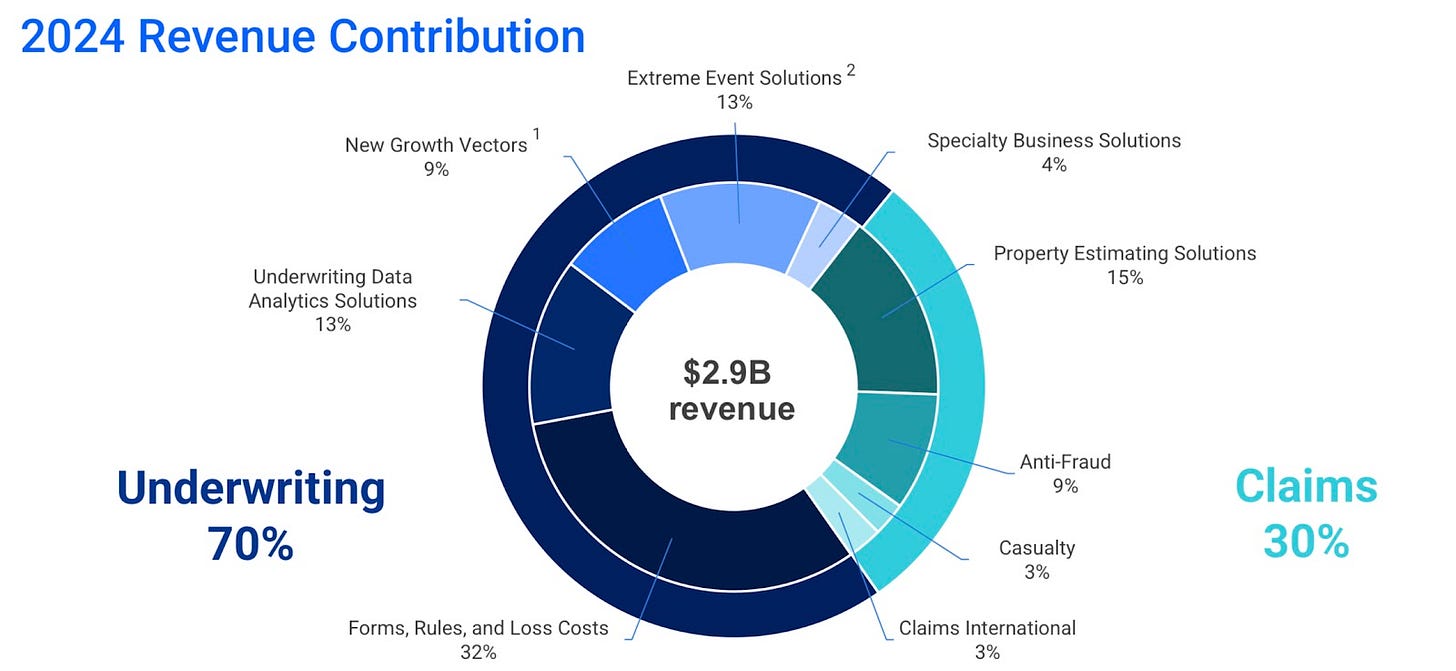

They have only one reporting segment, but they split the revenues into two parts:

Underwriting- a service that lets insurers know whether to offer a certain customer insurance or not, and analyse the risk associated with that.

Claims - this is the part where they get revenue from the assistance in helping their customers deal with claims, the whole process as well as fraud detection, which is crucial for s company to operate efficiently. This segment also includes revenue from evaluating damage and costs.

Here is a visual representation of their revenues:

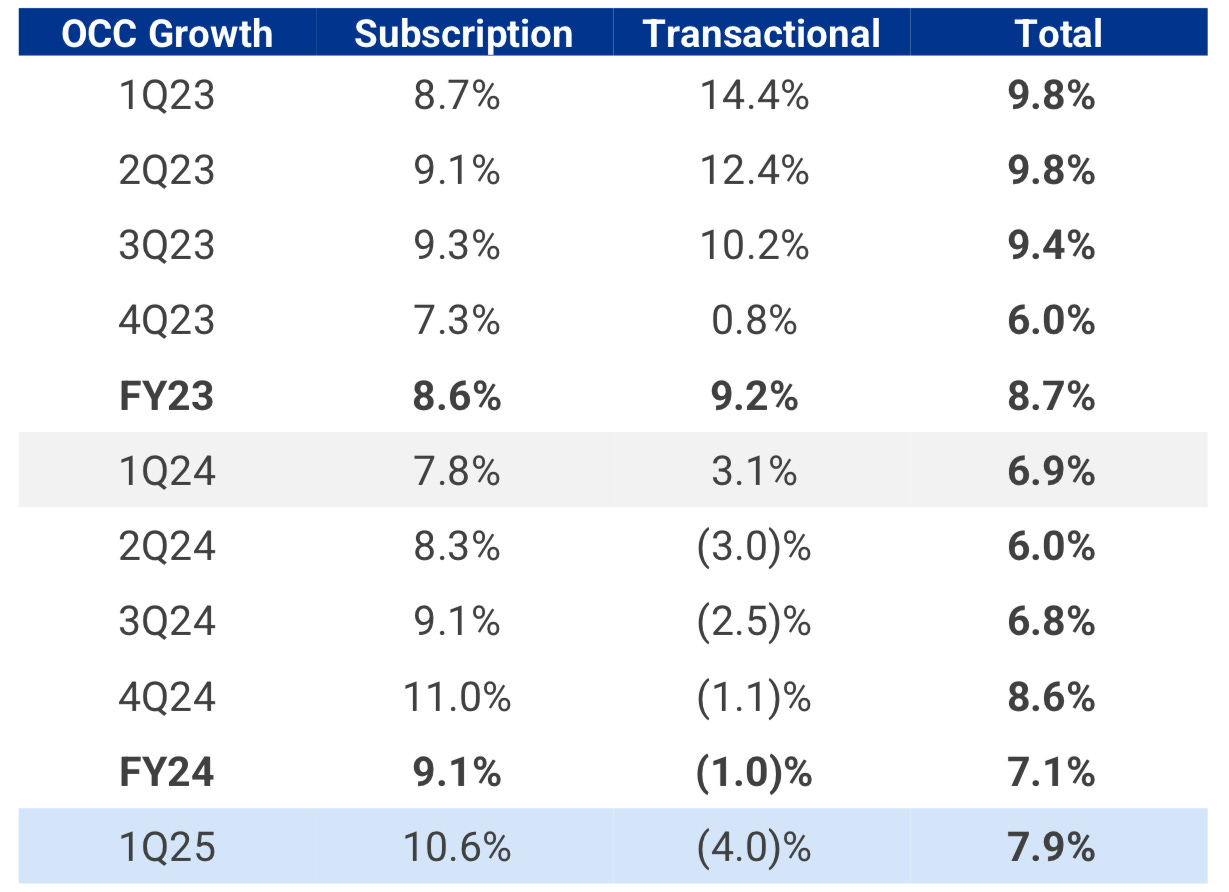

In terms of seasonality or cyclicality, I can say that for Verisk, we don’t see huge amounts of cyclicality, due to their customers usually paying in advance, every year for example. Their products can be used on a pay-once basis or subscription basis, and we can see from their investor presentation, that they are on track to convert more and more of their customer base into committed subscribers, similar to Duolingo or Amazon Prime.

OCC growth means organic constant currency growth, or that all ofthee money that the company makes is converted into one currency, and then the impact of acquisitions or divestitures isn’t counted, showing a more realistic revenue.

Here you can take a look at their financial efficiency metrics:

We can see that they are clearly better than their peers, with their metrics significantly higher than the median value for all the companies presented. At the same time, you can clearly see companies which are better avoided. Ok, let’s move on to the health of a company, as it’s really important:

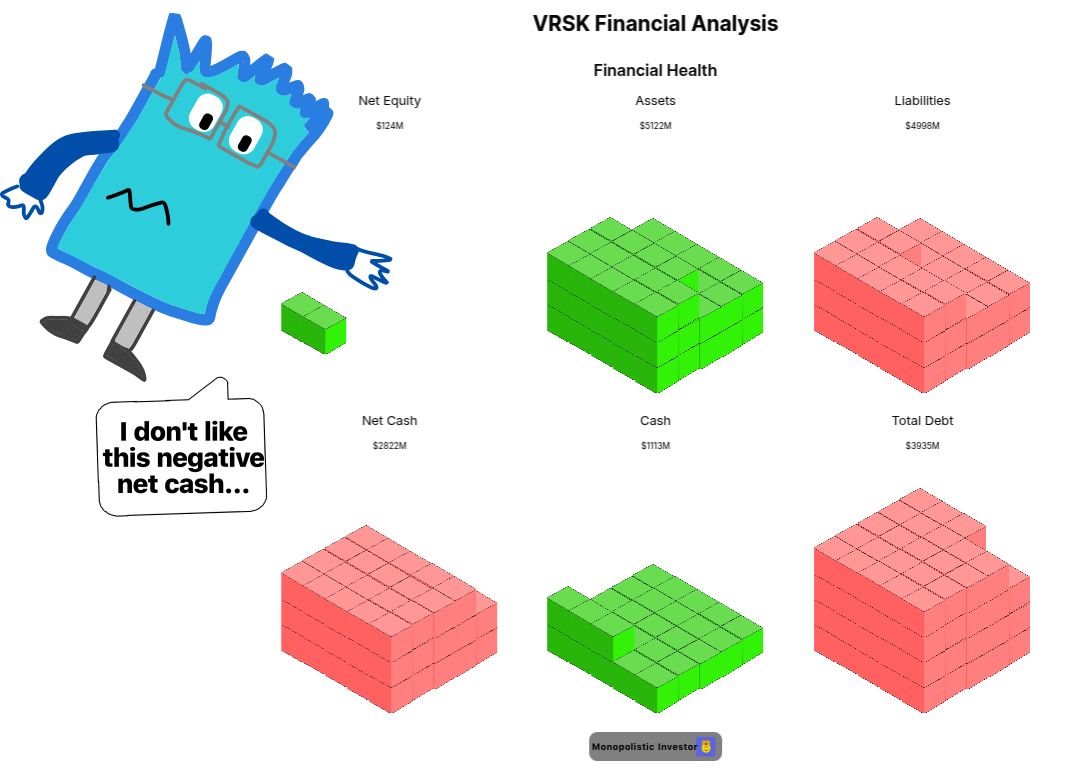

What is Verisk’s financial health / Is Verisk financially stable?

We can see that Verisk has a positive net equity, which stands like a guard for this company, and it’s positivethat it’s here, because if it wasn’t, there would be huge problems for the company, like financial instability, increased risk of bankruptcy, and thus can mean Difficulty in Obtaining Financing.

We have more assets than liabilities here, so don’t worry too much, but it’s a yellow flag to watch.

Market share of Verisk (VRSK) / Is Verisk a monopoly?

I like buying high-quality monopolistic companies - the ones with huge barriers to entry - let’s see if Verisk could be considered such a company.

Network effects - the more users in an app, the more value is created - this is true for Verisk, which has billions and billions of data records on insurance, meaning they have a lot of ways to analyse their customers’ needs.

Experience: Verisk has been offering its solutions to customers for over 25 years, gaining much-needed knowledge and expertise in the industry, as complex and regulated as insurance

High margin - Verisk’s high profit margin shows that they still have growth ahead of them

It’s really integrated into the insurance industry, as they have ready made copies of legal paperwork, thus making it easier for companies to do business. Great!

While Vern is exaggerating here, notice how 12% of the market is still a good result, and its competitors on this pie chart may not always be the best pick for this analysis, so some of them might be wrong, but overall, a solid company here! 🙂

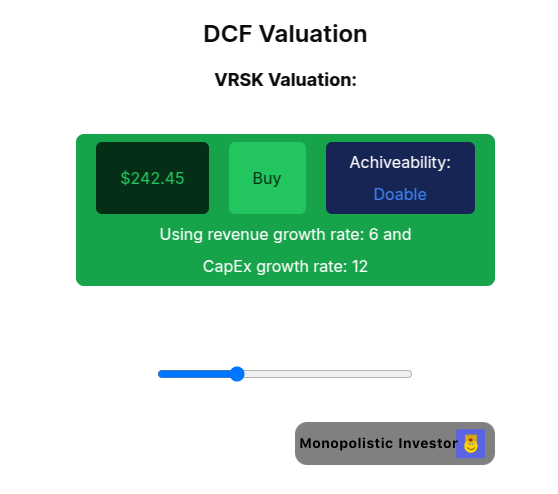

What is the fair value / what is the valuation of Verisk (VRSK)?

For this, we’ll do a discounted cash flow analysis, which states that a business is worth the sum of its future free cash flows, discounted (worth less) than they are today.

For the revenue growth rates, we’ll take a bit from their guidance, which was issued in Q1 2025:

The lower end of their guidance is 6%, and the higher end 8is %, so we’ll implement those two revenue growth rates, as well as a 0% growth rate, just to see what happens!

6% revenue growth ($242.45):

8% revenue growth ($286.37):

0% revenue growth ($137.64):

Benjamin Graham, the father of value investing, came up with a formula decades ago that still works to this day.

Classic version ($392.97):

Revised version ($222.70):

You can notice the fact that those prices are significantly lower than those shown today:

VRSK 0.00%↑ $298.28 - and that doesn’t offer me enough margin of safety when investing :(

Memes I made on Verisk:

Conclusion:

Verisk is a company with a very wide moat, a huge, resilient customer base, and lots of data on insurance, as well as expertise in its industry. What I’m doing right now is nothing, as I see them as currently overvalued, as we can see from the image, and not too many opportunities (as of right now) to grow. But if someone likes boring businesses (like me), wants to overpay (not me), and has some strong projections for that company (not me), maybe he should invest in this company!

PS. Please let me know what you think of this format of an article!

This isn’t financial advice.

Great analysis! And a good company to keep an eye on.