Visa - a simple business empire

Visa. A name everyone says all around the world. A giant company which has servers humming with immense computer power. Meet a marvel of our times: Visa.

Stock Information

Visa is a US based company which operates as a middle man between the payee and the payor, and collects money every time money is sent from the payor to the payee.

It’s convenient. Who uses lots of cash, these days? :)

It’s safe. Visa has robust security measures to ensure the “TAP” is secure.

It’s in demand is all the time. Ever seen an American Express card? I have only seen two in my vacation job at McDonald’s and none of them worked. Haha! :)

A very decent market share (39%) and also, have a look at their transaction speeds:

Revenue Growth

Mr Krabs would like to have predictable revenue growth. but does Visa have it? Let’s see! :)

Visa has around a 9% revenue growth rate, outpacing inflation by at least 5%! Great! For such a well-established company, that is a superior return, right?

Have a look at this interactive chart I made:

Financial Health

There’s nothing worse than buying a stock that has a “cold”, similariliy to what happened in “Wreck-it Ralph”:

"Look for companies with sufficient profitability to pay off their long-term debts in 3 or 4 years." - Warren Buffett

Can Visa do that? You sure bet! :)

Debt / EBITDA: 0.84

Which means 0.84 years = approximately 10 months. 10.

Here’s my visualization:

Now let’s move onto the valuation…

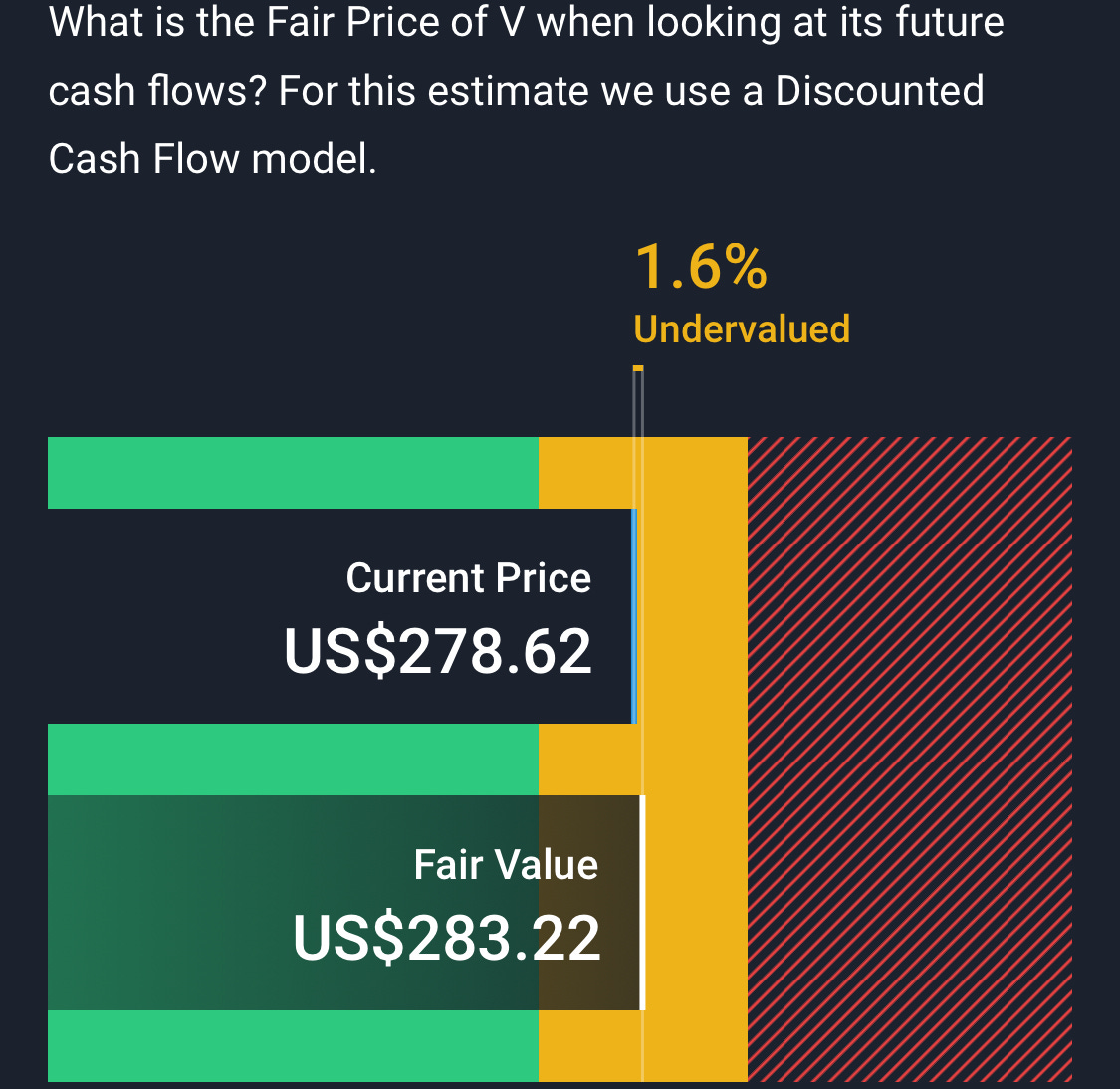

Valuation

As we can see, they are trading below fair value, albeit not by a large extent.

Profit Margin

We are lookingh for companies with the best profit margins… And Visa is one of them! 54.72% is a profit margin not even Microsoft, (yes Microsoft!), can beat.

Conclusion

One of the best stocks to own. A near monopoly.

Let me know what I can improve! :) I’m also open to any collaborations!

I have a funny youtube channel here about investing:

https://www.youtube.com/channel/UCUzb5F8urjVSLP1bRqm_9TA/

This isn’t financial advice.