Hello everyone. Who doesn’t throw out trash. Robots. We are humans, and so we make trash like water bottles, paper, broken phones, among other things. Many people throw out their trash without a moment’s hesitation, but what if I told you that a company whose name is so boring, can be at the centre of it all? The name of it is Waste Management, and we’re going to see whether they are a high quality company - but this article will be different than previous. Let’s go!

A quick reminder:

you can access most of the charts through the investing software which I developed (Free 30-day trial):

Then login here with the same email:

Let me know what to change! :)

You might think that they just collect your trash and dump it on the landfill - that couldn’t be further from the truth, as they are actively engaged in the sorting of these materials and then reselling them to users:

Not only do they do that, they engage in the production of renewable natural gas, which is created when landfill materials decompose.

Here are some of the most important business metrics of Waste Management:

Here we go over the positive aspects of the business.

Their impressive market share percentage is what makes it even better. Remember that we are looking for companies that have a dominant market position, as then economies of scale kick in.

Their focus on making their services cheaper, and keeping prices low for consumers (similar to how Costco works - increasing prices every few years, to keep as much of them as possible).

Their future ventures include autonomous vehicles, and an already working landfill solution, which makes LNG creation easier:

Their high barriers to entry in the form of a highly regulated industry deter competitors - landfill creation and management isn’t an easy thing to do.

Capital heavy business- all those trucks, equipment, software and land costs - a significant element of their moat.

Most of the times the local municipality doesn’t want to have many waste collector companies operating on one terrain, so most of the time WM is the only or one of the two available waste collectors in a given market.

Their ability to integrate AI into their business is crucial for their survival.

As you can see from the image above they are dependent on technology, which could expose them to some risks like cyberattacks. Especially when you consider that they will use autonomous vehicles, security is crucial.

While their business is evergreen, it doesn’t mean that it’s always great - changes in consumer spending can affect their collection methods (eg. More organic, less plastics collection), but overall that doesn’t seem to be a bug issue, as people will still produce waste.

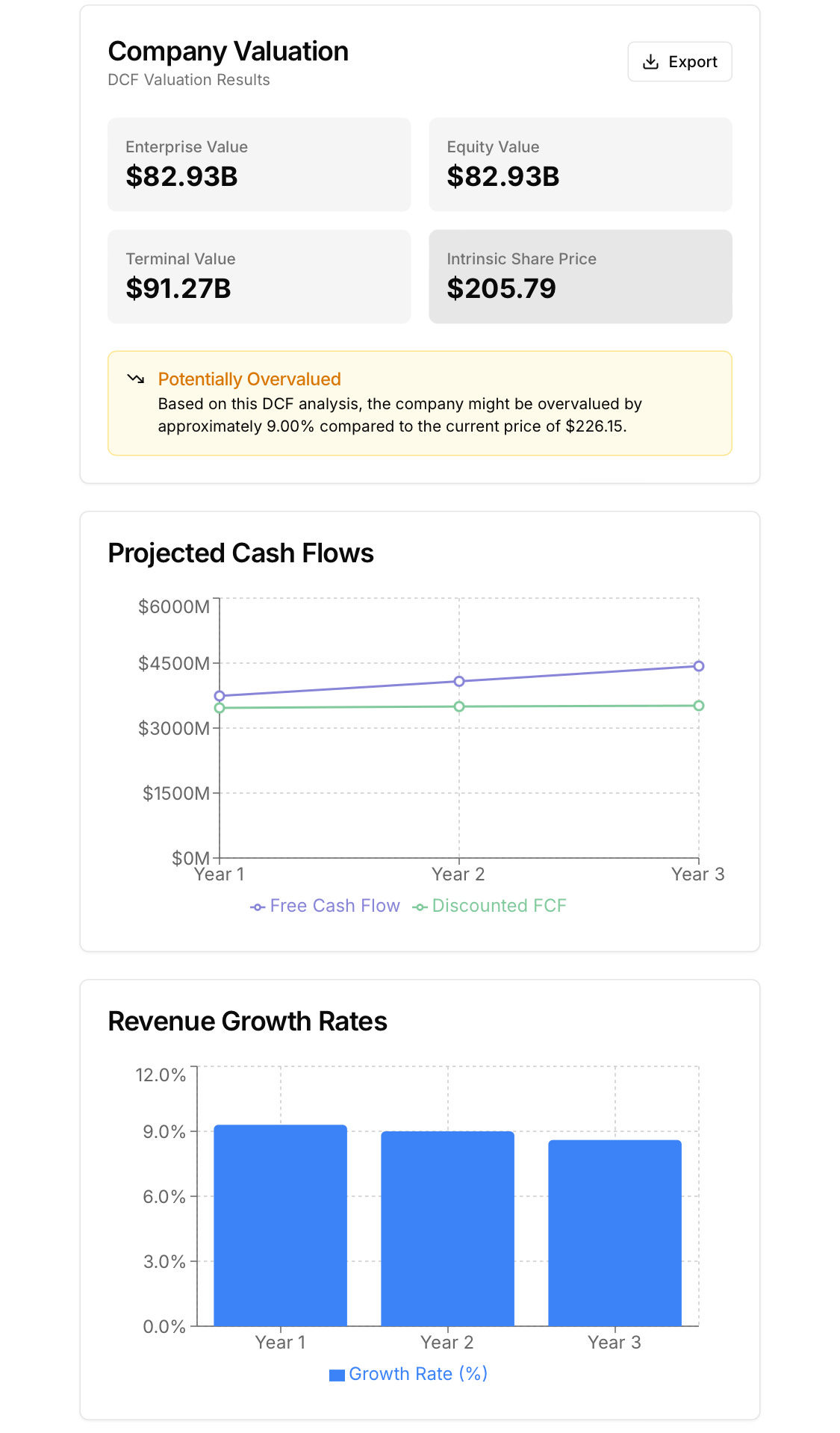

Based off the investor presentation, we can get around 9.33% annual growth rate up to 2027. So this can be put into our DCF valuation.

We can see that even if we account for management’s guidance, we still fall short of $205.79, compared to the current price of $226.15.

I think that this is a good company, with a dominant market share in the US, but it’s currently priced at a too high of a valuation - I won’t invest in it. One of the other reasons I don’t invest in them is because I think it doesn’t offer me the best returns - Google and Uber seem better.

This isn’t financial advice.

Stay monopolistic.