Wingstop.

Dring. A small bell rings, as you enter your favourite local chicken restaurant. You come over to the huge touchscreen POS (Point-ofSle) system to order your favourite chicken with fires dish. It comes out in a matter of minutes. You dive into it, sitting by the wind and looking out at the dark, rainy weather that is happening outside. As you sit there, you can’t think but laugh to yourself, as your friends thought you went to a Burger King. When you told them about Wingstop, no one laughed. You can’t help but wonder, just what is this company like? Can it be a good investment? Let’s see! :)

Stock Information

Before diving into the finnancials of a company, it’s an absolute must to know exactly what is the business like, and for that, I use a a 10-k report. Boring as a chemistry class at school. During that, I make active reading, so I ask myself questions about a company. I’m doing that for Nvidia currently, and you can look at the latest notes here:

https://monopolisticinvestor.substack.com/p/investing-journal-nvidia-continued

But for the sake of this article, I will do a faster version. Here we go:

WIngstop is a company that is the maker of chicken-themed restaurants, with over 2,550 locations. It operates as a franchise model, where each new restaurant needs $10,000 as an upfront payment from the franchisee. What is a differentiating factor in their business is the lack of heat lamps on premises. Everything is made on location. Hand diced carrots, salads, sandwiches, its all made to be pretty healthy. Their business is similar to that of Texas Roadhouse, a company that is also a restaurant, making steaks however. Wingstop is planning to be the owner of 4,000 restaurants internationally, and 6,000 restaurants in the US. But what are their competitors? Let’s look at their market share, which was created using my tool, available at https://market-share-chart.sketchthread.com/ :

I removed Aramark and HTHT, as those two, a food service provider and a hotel management business, are not their competitors. You have to understand, that my tool makes mistakes sometimes :)

We can clearly see that Wingstop doesn’t have the vast majority of the market, which is currently held by some of the industry’s biggest giants: YUM and QSR (A holding in Bill Ackman’s portfolio). I’m not happy about the current market share of Wingstop. I would like it to be better, but let’s move on!

What are their financial efficiency ratings, or more simply, how much cash is that business generating? For that,. let’s look at their return-on-capital ratio, which measures the returns that are made by the company on its investments.

Here you can see my chart (also developed using my tool), which shows the medians of many important aspects of financial efficiency for a company. If it’s green, it’s above the median. So we can look at the metrics here, and see that Wingstop falls pretty well besides its competitors, we can see that SHAK, which some can call a McDonald’s killer, is basically 1/20 efficient as Wing, so a bit funny here.

Ok, so what else can we get to know about the company we’re analysing here? We’re going to have a look at their profit margins, or how much money per $100 bucks are they making, just like Greg in Diary of a wimpy Kid did, when he opened his lemonade stand with Rowley!

Their profit margins offer some possibility of margin expansion in the furture, as their profit, operating and gross, are, 17.37%, 26.57% and 48,08%, respectively. What does it mean? It means, that for every $1 they make, almost half is intercepted by the company. That’s nice! Although after tht the government will take some, and employees, it’s still a nice one! :)

Now let’s see what their financial health is like!

Financial health

We look t the financial health of a company to see whether there’s a significant cash balance and or/ positive equity of sharreholders in the business. Why? Because we don’t want to end up like the so called “investors” of meme stock craziness.

Alright, end ofjokes, here is a financial health of Wingstop, portrayed by 125 blocks, made by myself (I’m a programmer) - using my tool:

Oh no! We can see that Wingstop is under a lot of pressure from its debt burden it so unforgetfully put on itself. I’m sad. Even the net equity, which could have been a small green light of hop, has diminished tpo the eternal sea of red. Red is bad.

But all is not lost (I think)

Their debt to equity ratio is at N/A, so I don’t even know what to look for. However, a Debt/FCF shows 11! Noooo! :Let’s move on to the next section. Wingstop disappointed mne a lot here! :(

Revenue growth

We want strong, predictable revenue growth, that is accelerating year over year, (that is target at least). Does Wingstop offer us such an option?

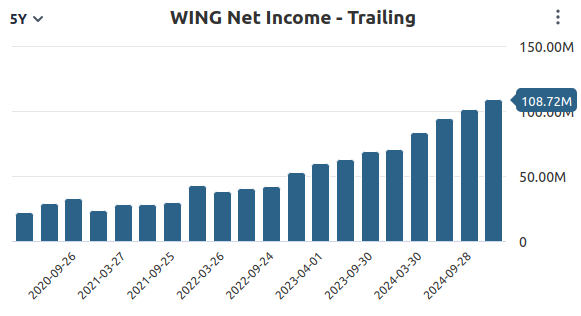

We can see strong revenue growth coming from them, as well as their net income increasing, which is always a good sign! :) Excpet of course, if we leverage ourselves too much!

Can they grow like that forever? No. But will they for the next five years? I think yes.

Valuation

time and time again, I see the same thing: Millions of shoppers hunting fro discounts, yet overlooking many stocks, right in their very own pockets! (Phones) We don’t want to overpay for groceries, but sell out of stocks, in which we buy their products! This has to end! Is Wingstop such a company? For that, let me jump staright to two valuation models I have programmed recently:

A more aggriesive valution:

A more conservative scenario:

Benjamin Graham formula:

So we can see that the average fair value is $302.73, suggesting uspide from today’s price of $232.06.

Conclusion

A really interesting company, with high revenue growth, but overhead storm clouds in the form of debt isn’t what I’m looking for, but I think any investors in this company will be greatly rewarded. I, however, am happy with my portfolio right now, as I don’t want any more stocks (for now).