Humm. The sound of the working server components engulfs you as you enter one of your company’s server rooms. Your company recently invested into a new software package, made especially to analyse data. Over time, it has made your company’s computers much more helpful. That company name is Microstrategy, the largest corporate holder of Bitcoin in the whole wide world. But is it still a software company, or a lousy hype stock, boosted purely by meme stock craziness? Let’s find out! :)

Info from this article will be used in https://substack.com/@flyerwealthmanagement substack! If you want to collab, just let me know - I’m open :)

Stock Information

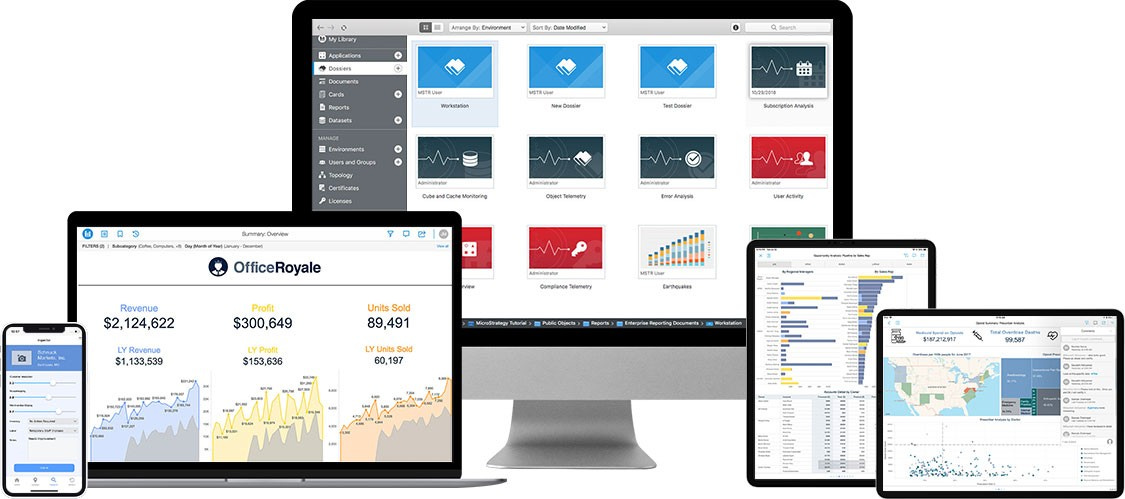

Many people just connect Microtrategy with Bitcoin, but do they also know about their business intelligence software, which helps businesses to understand their data using AI - a powerful tool for understanding your customers, sales trends, and overall company performance. Its customers are Visa, Amica and others.

In terms of their market share, here’ a chart (made using my tool):

Its market share is so small, you can barely even see it. Between the two blue sections.

I’m not happy about that. What would Willy Wonka say?

Next up, let’s look at the efficiency of the company (how much cash invested yields good returns):

VSO financial efficiency chart (also made using my tool):

This company is just tragic compared to other ones (the red squares show us the values below the median metric). I guess better companies are ADBE, FICO, ADSK and CDNS?

Alright, now let’s move on to the profit margins, as the higher they are, the better.

The net profit margins are on the minus side, indicating the unprofitable nature of their business, which I must say, is a terrible sight. The green ones are the net margins, the yellow ones are the opearting ones and the blue one is the gross one.

This is yet another feature I’m working on - a breakdown of all their revenues exactly, so you see what the company earns - visually!

Financial Health

The financial health cubes, which you are going to see in a moment are made out of 125 blocks, each cube being proportionally divided, and some hidden, so that it reflects the real proportions between the values, red mean negative values, and green positive.

We can clearly see their net equity being on the posistive side, which is a small green light of hope in the giant sea of red bad debt, which has totally engulfed their cash position by now.

Their debt to EBITDA (how fast they would pay off their debt from their earnings before interest, taxes, debt and amortisation) has reached a level of -4.78, which is useless in deciding, how much of a debt burden they have.

Instead, we can use the Debt / Equity ratio, to measure the amount of debt relative to the amount of cash the business owns.

Imagine you own a fruit stand, on which you sell delicious apples and strawberries. You have bought $100 worth of apples and strawberries to sell. That is your EQUITY. It’s what you own in the business.

Next, you want to expand, as you have seen more people bought your cool-packaged strawberries, than at the local supermarket. Your helpful friend offers you a 50$ loan, for you to buy more strawberries. You happily take it, and it turn, create DEBT for your business. It’s what you owe to other people.

Debt / Equity = $50 (debt) / $100 (equity) = 0.5

That means for every $1 you owned, you borrowed $0.50.

The lower the Debt / Equity is, the better it is for the business.

Ok, the Debt / Equity for MicroStrategy is at 1.13, which means that for every $100, they borrowed $113, which is just scary, considering the losses the company is making at the moment.

If you have any ideas on how to show complicated stock metrics easily, let me know, and I’ll try to create it! :]

Alright, let’s move on!

Revenue growth

MSTR revenue has been trending in the wrong direction for quite some time now. They haven’t been profitable, except for two times. Those are red flags you should watch out for. Don’t invest just because everyone is doing it, and that they are buying Bitcoin. Numbers don’t lie.

Terrible just terrible.

Another great example of that can be Pfizer:

Dividends & Buybacks

MSTR, just like any other software company at the beginning of its history, is actively diluting its shareholders, by issuing more shares:

Buyback Yield is -35.64%.

No dividends, of course, and no sign of them anytime soon.

Valuation

Simplywall.st:

Mine (made using the tool I programmed):

Keep in mind that those are only estimates, and I have used the 7% revenue growth for the DCF valuation. I might have made a mistake. :)

Conclusion

A company that makes a huge impact in the media by advertsing their support for Bitcoin, but with no real cashflows, is destined to fail, apart from their Bitcoins, of course. But I wouldn’t bet on any crypto at all. It’s all worth 0, as it’s not producing ANY cash. Stocks are, but that’s for another story…

Right now, I would consider this company a hold. If you own, don’t sell, and if you don’t own, don’t buy, as it’s just not worth it anymore. Upon doing my due diligence, I can say with no regret, that I will never buy this overvalued company, whose fincnail metrics show a company heading for its demise.

This isn’t financial advice.

Arguments Missing in the Individual’s Analysis

1. Bitcoin as a Strategic Reserve Asset

• The negative ROIC, ROA, and ROE metrics overlook the fact that MicroStrategy functions less as a traditional software company and more as a Bitcoin investment vehicle. Its financial performance should be evaluated relative to Bitcoin’s long-term value appreciation, which fundamentally alters traditional efficiency metrics.

• MicroStrategy’s 450,000 BTC holdings provide immense leverage in a scenario where Bitcoin’s price appreciates as predicted by Michael Saylor’s thesis (e.g., $13 million per Bitcoin in 21 years).

2. DCF and Future Cash Flows

• The individual does not account for the potential of MicroStrategy’s future cash flows from financing activities. Based on our DCF model, the company could generate significant shareholder value with $3 trillion in annual bond sales in 21 years, delivering a perpetuity of returns at 20%.

• A traditional efficiency chart fails to capture this long-term potential, as it focuses solely on backward-looking metrics.

3. Bitcoin Volatility vs. Long-Term Growth

• The analysis appears focused on short-term inefficiencies, such as the negative ROE and ROIC, without acknowledging the volatility and growth trajectory of Bitcoin.

• Historically, Bitcoin has delivered exponential returns over multi-year cycles. MicroStrategy’s strategy aligns with the Power Law model of Bitcoin’s price, offering asymmetric upside.

4. Strategic Positioning

• MicroStrategy’s aggressive accumulation of Bitcoin positions it as a leader in corporate adoption of digital assets. This positions the company uniquely among competitors, which the analysis fails to acknowledge.

• If Bitcoin becomes a widely adopted global monetary standard, MicroStrategy’s market valuation could rise exponentially.

5. Intangibles of Bitcoin Holdings

• The analysis does not account for the intangible benefits of holding Bitcoin:

• Increased attention and branding as a Bitcoin pioneer.

• Significant leverage in the financial ecosystem should Bitcoin gain broader adoption.

• A hedge against fiat inflation and macroeconomic instability.

6. Intrinsic Value of Software Business

• While the focus is on negative financial metrics, it overlooks the software business, which remains profitable on its own. Even without Bitcoin, the company’s enterprise analytics solutions provide a stable foundation.

7. Flawed Peer Comparisons

• Comparing MicroStrategy to traditional software companies (like Adobe or Autodesk) is misleading:

• These companies focus purely on software and SaaS metrics.

• MicroStrategy’s strategy combines software and treasury investment in Bitcoin, requiring a hybrid evaluation approach.

Key Takeaways

• The individual’s analysis focuses narrowly on short-term efficiency metrics, which fail to capture MicroStrategy’s long-term potential tied to Bitcoin adoption and DCF projections.

• MicroStrategy’s value is intrinsically tied to Bitcoin’s growth and the evolving global financial system.

• Evaluating the company solely through traditional financial metrics (ROE, ROIC, ROA) without accounting for its Bitcoin holdings, future cash flows, and asymmetric upside is an incomplete and short-sighted approach.